Stock Option Trading Strategy – Exiting mining and heavy equip calls, keeping call credit spreads.

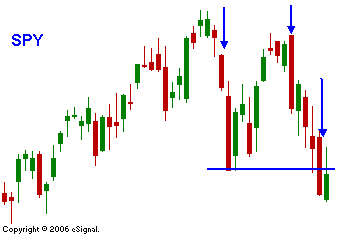

The market has finally found resistance. It established a new all-time high a few weeks ago. The first crack in the dam came with the gap down off of those highs. The next day, the market dropped sharply and it established a relative low. The steep uptrend was broken. In typical fashion, the market had a snap back rally that shook out the bears and challenged the all-time highs. The second arrow in the chart depicts a higher open and a key intraday reversal. Since then the market has opened on its high of the day and closed near its low of the day. This bearish tendency led to another big down day, one that broke the relative support that was established a few weeks ago. The market is forming a top.

Unlike February’s fast and furious plunge, this price action has been very controlled. The bulls do not want to see a market that gradually makes lower lows and lower highs since it could lead to a sustained decline.

All eyes will be on Thursday’s FOMC comments. I am not expecting any change in rhetoric and I believe the market will have a negative reaction. The PCE Index will give us another glimpse of inflation before their statements are released. If the number comes in “hot” it could lead to a drop before the comments are released. A breakdown below SPY 146 would be bearish. That would represent a failed breakout from February's highs.

While this current price action looks very negative, I am still hanging on to my "buy the dip" mentality. I believe earnings are solid, interest rates are relatively low, employment is robust and global economic growth is strong.

The Yen-carry trade was a wild card that could have had a devastating effect on the market. The first warning shot was fired in February and traders that were overexposed took notice. As interest rates head higher, they have had time to unwind their positions and I believe that “surprise component” is diminished.

There might be an opportunity to make money on the short side. However, the snap back rallies in a market that is trending higher are fast and furious. I believe this market drop will set us up for a great buying opportunity. The market just needs to run its course and adapt to higher interest rates.

The heavy equipment and mining stocks are starting to show weakness so I am exiting those positions. They have been a scratch for the most part. I will continue to hold my call credit spreads positions on retail and restaurant stocks. My current exposure is very light.

Daily Bulletin Continues...