Stock Option Trading Strategy – Cash and a few call credit spreads on restaurant and retail stocks.

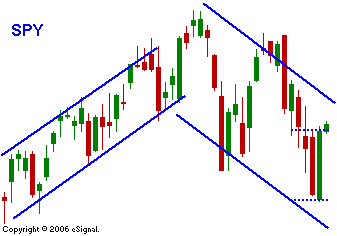

So much for a weak technical set-up for the market. When I wrote yesterday's commentary, the market was weak and major support levels were in jeopardy. When the bears were unable to keep the pressure on, the bulls stepped in and took charge. Along the way the shorts ran for cover, fueling the rally. The end result was an engulfing pattern that is considered to be bullish. That means the open and the close eclipsed the prior day’s open and close. What makes this even more incredible is the fact that Tuesday had a large range. In the chart I have drawn two channels. They help you see the increase in market volatility during June. These large ranges tend to precede a big move. The rally resulted from a 3% drop in durable goods orders in May. Bond yields retreated and the market viewed that as a positive. In the last three weeks it seems like once the daily direction has been determined, no one wants to stand in the way of the momentum. As I mentioned in yesterday's commentary, the market can take weeks of negative price action and destroy the bears in a single day. Today, first quarter GDP fell to its lowest rate in more than four years. The implied inflation gauge showed that core prices rose at a rate of 2.4% in the first quarter. This is “hotter” than the Fed would like to see and it came in higher than the expected 1.8%. This figure does not even include food and energy and we know what those prices have done. I believe the Fed will maintain its current rhetoric. However, I believe that there is a remote chance that they may even strengthen their "tight light" bias by expressing concerns over food and energy prices. It amuses me when these components are left out of the equation. They are huge expenses in our day to day lives. Leaving them out is analogous to my neighbor who comments on my putting, "…apart from speed and direction, it will as a great putt.” Global rates are headed higher and eventually, so are U.S. interest rates. Once the market adjusts to the shock, it will be able to regain its footing and move higher provided that growth and earnings are stable. I am currently in cash and I only have a few call credit spreads on in the retail and restaurant groups. I want to objectively evaluate the next big move and wiping the slate clean will help me do that. I suspect that my next large position will result from buying a market dip. I would not advocate taking any large positions ahead of the FOMC comments. On the one hand, I see a chance for stronger comments about inflation and the market would react negatively. On the other hand, the market has had a positive reaction after recent FOMC releases and it breathes a sigh of relief. We are “dead till the Fed”. Let’s see what happens.

Daily Bulletin Continues...