Stock Option Trading Strategy – Taking profits on energy, heavy equipment, mining call options.

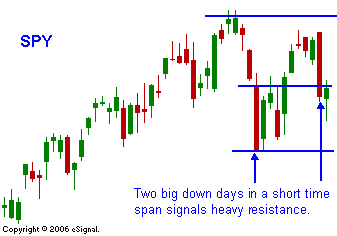

Yesterday we saw the market drift lower in the absence of news. This is similar to what happened two weeks ago. This marks the second large one day drop in a short time span and I believe it signals heavy resistance. Higher interest rates were once again the focus yesterday. If the decline was due to heavy selling, I would be concerned. It's more a matter of the bids disappearing. Buyers are choosing to step back as the market picks up downward momentum. By late afternoon the S&P 500 futures had lost 20 points. Asian markets were up strong overnight and that should contain any major follow through to yesterday's selling. The Philly Fed came in strong a few minutes ago and that is also helping. In the chart you can see that the second blue line was breached. I have been using the open from Thursday two weeks ago as a support level. That was the first big down day. If the market breaks below the lower blue line (Thursday’s close) it is likely the market will test SPY 146. Next week there is an FOMC meeting. The market has been receptive to the comments the last few months. I am not expecting the Fed to change their rhetoric. With global and domestic interest rates creeping higher, there is a chance for a negative reaction. The market will need a solid piece of macro economic news to penetrate the strong overhead resistance level. As long as the market is below the middle blue line in the chart, I am short-term neutral. This market may need a good washout before it can move higher. I've taken this opportunity to take profits on energy stocks and I am also selling the majority of my heavy equipment and mining stock call positions.

Daily Bulletin Continues...