Thursday’s Stock Option Trading Strategy!

The stock market is very weak and your option trading should wait for a capitulation low.

Yesterday, the market tried desperately to rally and the financials looked particularly strong. However, in the last half hour of trading, the market dropped sharply.

Overnight, Asian markets were generally higher with the exception of the Shanghai composite. The Chinese central bank decided to raise bank reserve requirements for the 11th time in the last year.

Once again, news from the financial sector cast a dark cloud over the market. Shares of mortgage insurers ABK and MBI were down 60% and 30% respectively in early trading. Moody’s downgraded the shares. MER announced earnings and revealed $16 billion in write-downs. The financials are like a dark shadow that follows the market everywhere.

Pessimism spread after the Philly Manufacturing Index was released. It hit its lowest level since the year 2001. Throughout the morning, Chairman Bernanke has been testifying before Congress. He sees worsening economic conditions and the need for immediate, yet temporary action. He feels that both monetary and fiscal policies are needed and they need to be efficient.

This most certainly translates into aggressive Fed easing, however the market has not responded with a rally. Perhaps that is because the Fed’s easing to date has not generated stimulus.

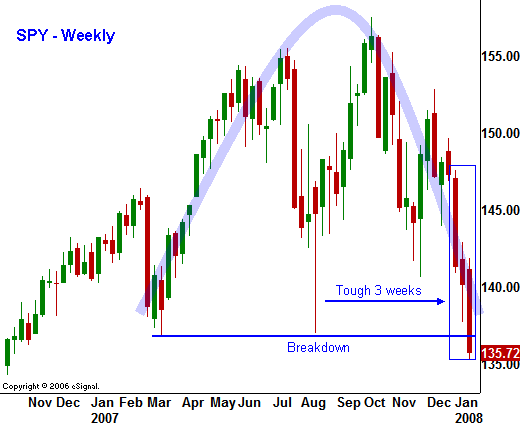

In the chart you can see the dramatic January decline that has taken place. The bulls are nowhere to be found and investors are taking money out of the market.

The VIX is starting to rise and the market leaders (AAPL, RIMM, GOOG, MON, POT, DE, RIG, PCU, FCX) are getting hit. This leads me to believe that we are getting near a short-term low. If the market stages a big decline and an intraday reversal back into positive territory, that will mark a short term low.

I believe that a mix of earnings next week could remind the market that the news is not all bad. However, I feel that for the first six months this year, the market will still be working its way lower. There are simply too many issues that need to be resolved.

The momentum is down and the market is making a 52-week low. Option expiration is generating sell programs and it is likely that we will close near the low. As next week approaches, I believe we will see the market stabilize as we get a broad mix of earnings.

For now, I would not sell any more put credit spreads until we see a bid decline and an intraday reversal. That could be the capitulation low we are looking for.

Daily Bulletin Continues...