Wednesday’s Stock Option Trading Strategy!

The stock market is shouldering weak news from INTC and I believe your option trading should include put credit spreads.

Yesterday, the market got nailed after Citigroup announced its largest loss ever. The write-downs continue, however, if you look at the XLF, you will see that financial stocks were not the cause of the decline. In fact, they are only down marginally today. Retail sales were down .4% in December and November's numbers were revised lower. Surprisingly, the RTH did not decline much either.

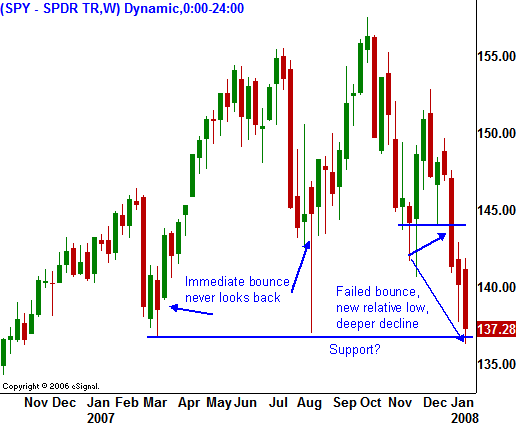

The big losers for the most part were last year's big gainers. Energy stocks were hit hard as oil prices backed off. Cyclical stocks that generate international revenues were also sold. If the global economic picture remains strong, these stocks will be the first to rebound. They trade at reasonable P/Es and have excellent earnings growth. You can't call today's decline a capitulation because the bottom has not fallen out. Also, the VIX has not spiked. However, I do feel that a short-term support level has been reached.

Bad news no longer weighs on the market like it did a couple of weeks ago. INTC released poor results, but that initial shock has worn off.

We have hit a major horizontal support level and it seems to be holding. In two weeks, the FOMC meets. A .5% rate cut is largely expected and I believe the market will hold up well ahead of the announcement. I also believe that the first big week of earnings set a negative tone because they were dominated by financial stocks. Next week, we will see a broader mix of earnings releases and I believe we will see pockets of strength.

Consequently, I expect a short-term bounce. This is a good time to sell put credit spreads on stocks that still have their long-term uptrend intact. Also, make sure that the companies are not dependent on US economic growth.

I still believe that on an intermediate term basis you need to maintain a bearish bias. Eventually, the market will bounce and when the rally stalls, be prepared to take bearish positions. This decline has been very orderly and that tells me that it will continue to head lower for some time.

There is one wild card for today. This afternoon the Beige Book will be released. It will reveal economic activity across the nation. If the market establishes a new afternoon low, it is likely that it will close below long-term support.

Start scaling in to put credit spreads and consider buying calls on stocks that are about to announce earnings and have performed well in recent years. Wait to see the market’s reaction to the Beige Book first.

Daily Bulletin Continues...