Stock Option Trading The Day Of The FOMC!

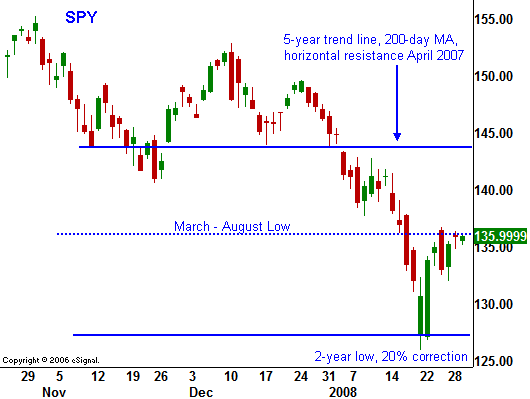

It is pointless to try and guess what the Fed will do or how the stock market will react. In the chart you can see that we are right in the middle of a likely range. There is considerable overhead resistance and there is decent support. Your option trading strategy should be to fade the range - buy low/sell high.

If the market rallies on the news, the move will eventually run out of steam, setting up a good short. There are too many issues that need to be resolved. There are signs of an economic slowdown and the subprime write downs have not stopped. Just today, UBS announced a $14B write-down.

If the market declines, I believe decent earnings across most sectors will contain the damage. Corporations have a war chest of cash and a will buy back shares. Artificially low interest rates will not yield enough to offset rising inflation and equities will be relatively attractive.

Bearish - Retail stocks have bounced and any continuation just makes them a more attractive short. The consumer is still under pressure and the earnings have not rebounded.

Bullish - Commodity stocks have declined and I see good value in energy, mining and agriculture. I also like very selective tech stocks. You need to pick stocks that will move. This is a traders market and you need to be in and out. Unfortunately, this means that cyclical stocks are probably not a great long. Even though the earnings have been good, the market will not sponsor these stocks unless there is a sustained rally.

Lighten up, evaluate and trade from a position of strength. Often, the market makes a knee-jerk reaction and then the next day, the true direction is revealed. Personally, I am hoping for a big deep pullback to last week's lows. I have spotted stocks that performed well when the market rallied and I would like a second chance to buy them cheap.

Daily Bulletin Continues...