Buying Call Options After The FOMC

There is an option trading opportunity ahead of the Unemployment Number. I believe the stock market has found short-term support.

Yesterday, the Fed was in an accommodative mood. It gave the market what it wanted, by lowering interest rates by .5%. In the last week it has lowered rates by 1.25%. During my 20-year trading career, I have not witnessed anything like this.

The move was largely anticipated. Normally, you would expect to see the market rocket higher on this news. It sputtered to a 20 point S&P 500 rally before caving in to selling pressure. By the close, the futures were down 11 points. I believe the Fed’s actions address credit issues. The banking system is in peril and liquidity needs to be quickly injected to keep the subprime disease from spreading.

Lower interest rates will not stimulate consumption at this juncture. Consumers are up to their eyeballs in debt. They are watching the value of their homes and portfolios decrease as the unemployment rate creeps higher. The impact of a weak dollar hits home when they start planning vacations abroad. High gasoline prices are also taking a bite out of discretionary funds. Retail sales figures and consumer sentiment data indicate that people are hankering down.

In short, the Fed’s actions signaled that danger lies within the financial sector. Traders are nervous because the sector lacks transparency.

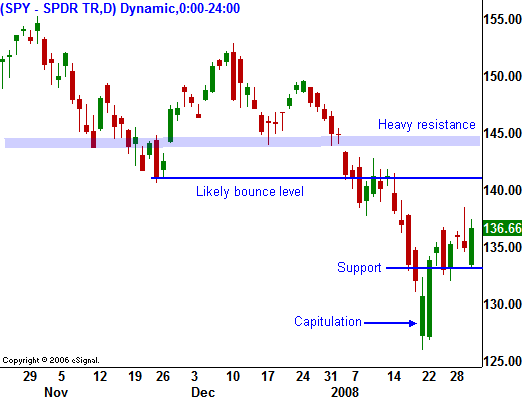

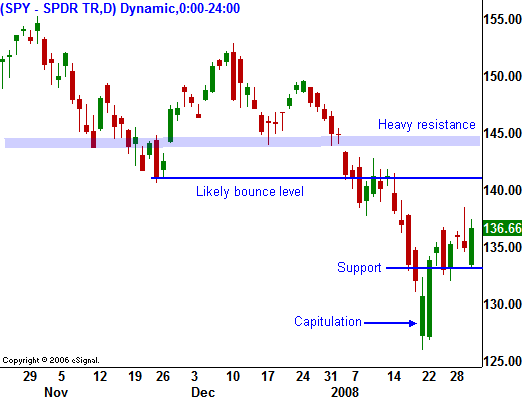

Corporate earnings have been decent and the guidance is lower, but not dismal. I believe that we have found a short-term bottom to this market. In the chart, you can see the capitulation low and a support level that is forming around the SPY 134 level. That was the low from last March and August and I believe for the next few weeks it will hold.

If the market has a negative reaction to the Unemployment Report tomorrow, it will present an excellent buying opportunity. I believe the number will come in better than expected and I am taking long positions today. The jobless claims numbers have been lower than expected the prior three weeks and today's number negated some of that optimism since it came in higher than expected.

Most importantly, the Fed has demonstrated its commitment to staying ahead of the credit problem. That will instill confidence in the market. When you combine that with decent earnings, a rally should materialize. Groups and sectors that have been badly beaten down are showing signs of support.

Commodity stocks are still my favorite play. Companies that distribute, supply or equipped producers are also in my crosshairs. My level of confidence is fairly high and I believe this is a good time to step up to the plate. This is a trader’s market; make sure to take profits as they materialize.

Daily Bulletin Continues...