Friday’s Unemployment Number Should Spark A Rally – Sell OTM Call Spreads.

Yesterday, the market tried to rally in response to decent economic releases. The ISM services number came in better than expected and it was above 50, which indicates expansion. Oil inventories showed an unexpected draw, however energy prices retreated after the release. This price action signifies that oil may have reached a short-term peak.

By early afternoon, the rally had faded. Rumors circulated that MBIA and Ambac might be downgraded by a rating agency. This created a round of selling in the financial sector and that weighed on the entire market. We saw a similar reaction earlier in the week when Standard & Poor's lowered its rating on most of the financial sector. As I mentioned a few days ago, I believe the rating agencies are way behind on their assessment. They are trying to cover their @## in case another shoe drops. If they miss that call, they will lose what little bit of credibility they have left. Banks have been able to raise capital and the write downs have been aggressive. These stocks are compressing and negative news tends to have a muted affect.

This morning, initial jobless claims came in lower than expected. The market has rallied in response to the number. Continuing claims are still over 3 million and while the market is fine with it, this concerns me. Tomorrow's Unemployment Report should be benign and I am expecting a positive reaction. Today's rally has taken some of the fuel out of tomorrow's potential move. All this week I have been painting a bullish picture based on the releases that were due.

Today, the market is also responding to decent retail sales numbers. The rebate checks are in a hand and once that spending runs its course, I expect this sector to rollover.

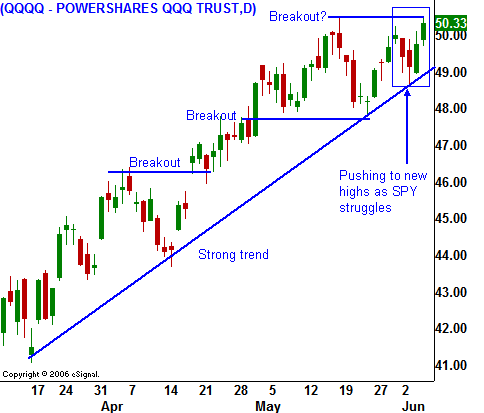

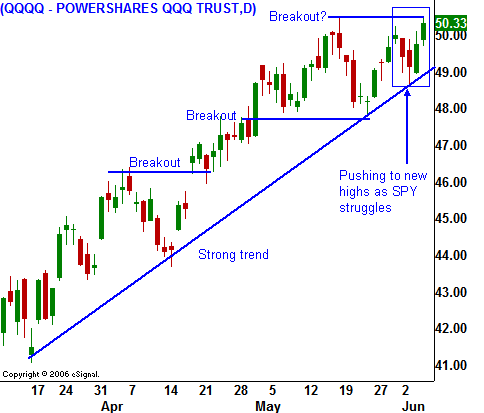

In yesterday's comments I mentioned that you could get long for the remainder of this week, but make sure to take profits by tomorrow's close. In today's chart you can see the relative strength in the tech sector. If you are looking for longs, I would stick to the semi conductors and software.

I don't want to time every wiggle and jiggle in this market so I will be approaching this rally from a different perspective. As the market moves higher I will wait for it to stall. I am evaluating July out of the money call credit spreads on financials, retail and restaurant stocks. Once the market hits resistance, I will start initiating those spreads.

There have been an increasing number of big down days as the market tries to rally back to the SPY 144 level. This is a sign that the overhead resistance is strong. The Fed is telling banks to get their capitalization in order and I interpret that as a sign that interest rates will soon move higher. Chairman Bernanke has voiced concerns over inflation. This morning, the ECB indicated that they may be raising rates. The market will have a tough time rallying to that resistance level if interest rates start moving higher.

For today, the A/D is a solid 3:1 and I expect the market to maintain most of today's gains. Once again, it has been able to bounce off of the SPY 138 level. It has been testing that support with greater frequency and I feel we will soon fall below it. Take advantage of this rally and look for OTM call credit spreads on stocks that have been in a long-term downtrend. Keep your size small.

Daily Bulletin Continues...