Good Chance For A Positive Week – Sell OTM Call Spreads On The Rally.

Yesterday, the market pulled back as financial stocks continued to struggle. The sector was downgraded by Standard & Poor's on Monday and traders dumped shares. As I mentioned in Tuesday's post, today's numbers should have a positive bias.

For the second month in a row, ISM services grew. The 51.7 number was better than analysts had expected. The ADP employment index tends to exaggerate employment and I take it with a grain of salt. It showed a 40k increase in jobs when a loss of 30k was expected. Oil inventories showed a draw that was much greater than expected and once again, energy prices retreated. This is contrary to what should happen and it appears that a short-term top and has formed for oil.

The market has responded with a rally. Tomorrow we will get initial jobless claims. Initial jobless claims have been coming in at 372,000 which should bode well for Friday's Unemployment Report. One thing to watch is the continuing unemployment claims. They have continued to grow each week and the number is above 3 million.

I am expecting deposit reaction to Friday's Unemployment Report. Last month, a benign number fueled a 30 point rally in the S&P 500 futures.

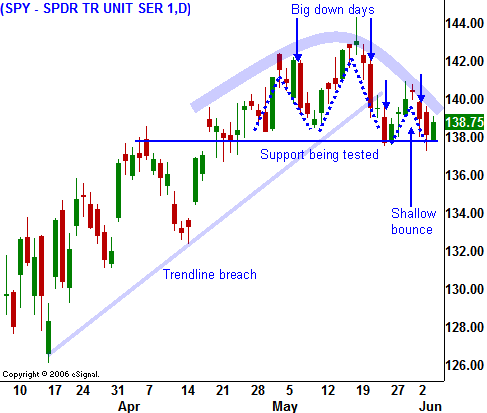

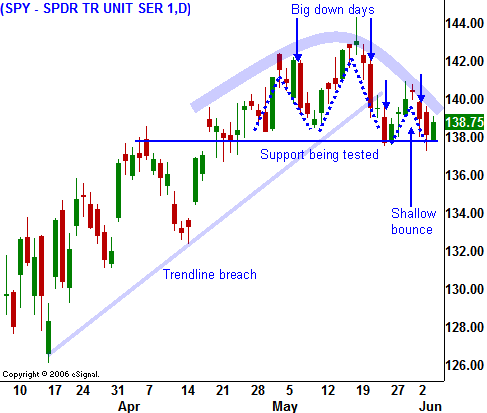

Before you get too excited, mind you that this rally will present a good opportunity to sell OTM call credit spreads. In today's chart you can see the overhead resistance and how the market is starting to crown. We've had a number of big down days and the horizontal support level at SPY 138 is being tested with greater frequency. I don't know if the market will breakdown or not. However, I do know that high oil prices, a weak housing market, poor performance in the financial sector, inflation, deteriorating economic expectations from the Fed and the possibility of higher interest rates will keep a lid on this market for at least a few months.

Decent economic numbers and lower oil prices should help to push the market higher today. I believe we will see the same tomorrow and Friday. If you want to play the long side, be nimble and take profits are heading into the weekend. Personally, I am not going to play this bounce because I feel it is a bit on the risky side. My OTM call credit spreads are working out nicely and I will look to add to them by selling July options once this rally stalls. Trade light.

Daily Bulletin Continues...