We Are Close To A Capitulation Low – Scale Out Of Bearish Positions.

This has been a tough week for the market. We traded at a new two-year low and financial stocks lead the decline. There weren't many earnings or economic releases to cloud the price action and it was easy to spot panic selling.

Today, concerns over Freddie Mac and Fannie Mae are weighing on the market. These "government-backed" agencies will likely be bailed out and stockholders will be left holding the bag. In other news from the financial sector, rumors that PIMCO has halted trading with Lehman spread quickly and the stock plunged to $17. Fear surrounds the financial sector and investors are worried that the crisis might spread to traditional loans. Next week's earnings will be dominated by financial stocks. Last quarter, worst-case scenarios were “priced in” and financial stocks rallied after posting dismal results. In the chart you can see the April decline and rally.

.

.

.

.

Foreclosure rates spiked by 50% in June (year-over-year) and one out of every 500 homes is now in default. A big round of mortgage resets is taking place right now and higher interest rates could place even more pressure on homeowners.

The Fed has been preparing the market for tightening. A quarter-point rate increase has been priced into September bond prices and another quarter point has been priced in for October. Next week, the FOMC minutes will be released. If they indicate that inflation is the primary focus, the market will have a negative reaction.

Energy prices are placing a huge burden on our economy and they just won't go down. This week, oil inventories showed a much larger than expected draw. The pullback in oil prices was brief over the last week and today we are right back up to $145 a barrel.

Next week, we will get the CPI and PPI. I am expecting to see an increase in the CPI. To this point, the PPI has been climbing faster than the CPI and companies have been absorbing higher costs. This will hurt profit margins this earnings season. Many companies have started to pass those costs on; however, they have cut back on production because higher prices are reducing the demand for their products.

The unemployment rate continues to climb and jobs are the cornerstone for this economy. Last week's Unemployment Report was dismal. We lost 62,000 jobs in June and the numbers for April and May were revised upwards by 50,000. Fortunately, initial jobless claims came in better than expected this week. It is only a one-week number and I would not give it too much weight.

GE announced its earnings before the open and they met expectations. Unfortunately, cautious statements about the future are keeping a lid on the stock. This multinational conglomerate is representative of how earnings season should play out. Soft guidance worries me and profit margins for some companies could suffer since they have not passed on higher costs.

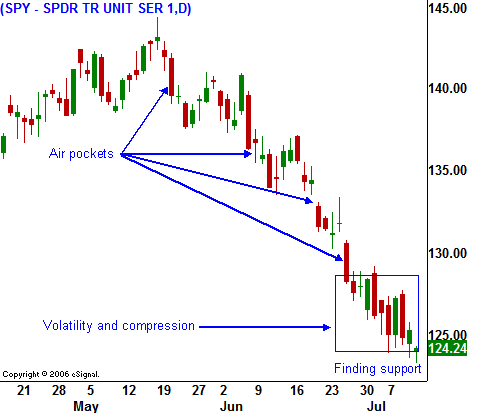

I am long-term bearish, however, I believe we will see a capitulation low soon. If you look at the second chart, you will see that the air pockets we experienced last month are gone. In the last week, we have seen volatile, two-sided trading action and prices are starting to compress. The bulls and the bears are fighting it out and we might be getting close to support. In order for us to find that capitulation low, the market must freefall. An intraday reversal with follow through rallies for two days would mark a significant support level. We might see that low and reversal unfold today.

I doubt that traders will want to hold stocks going into the weekend ahead of earnings next week in the financial sector. Fear is influencing trading and we could see a big drop today. The reversal would set us up for a bounce next week on the actual earnings releases. If you are going to trade this move, you need to have your stocks lined up. Look for situations where support has been established, the stock has maintained a long term uptrend and the stock has bounced during rallies. Biotech looks solid here.

Remember, this is a low probability trade. I am not looking for a sustained rally. Conditions (inflation, interest rates, unemployment, and earnings) are much worse now than they were in April and this bounce will be brief. As soon as the shorts cover, it will be time to get bearish again.

The better play at this juncture is to lighten up on short positions, wait for the bounce and then re-enter.

.

.

.

.

Foreclosure rates spiked by 50% in June (year-over-year) and one out of every 500 homes is now in default. A big round of mortgage resets is taking place right now and higher interest rates could place even more pressure on homeowners.

The Fed has been preparing the market for tightening. A quarter-point rate increase has been priced into September bond prices and another quarter point has been priced in for October. Next week, the FOMC minutes will be released. If they indicate that inflation is the primary focus, the market will have a negative reaction.

Energy prices are placing a huge burden on our economy and they just won't go down. This week, oil inventories showed a much larger than expected draw. The pullback in oil prices was brief over the last week and today we are right back up to $145 a barrel.

Next week, we will get the CPI and PPI. I am expecting to see an increase in the CPI. To this point, the PPI has been climbing faster than the CPI and companies have been absorbing higher costs. This will hurt profit margins this earnings season. Many companies have started to pass those costs on; however, they have cut back on production because higher prices are reducing the demand for their products.

The unemployment rate continues to climb and jobs are the cornerstone for this economy. Last week's Unemployment Report was dismal. We lost 62,000 jobs in June and the numbers for April and May were revised upwards by 50,000. Fortunately, initial jobless claims came in better than expected this week. It is only a one-week number and I would not give it too much weight.

GE announced its earnings before the open and they met expectations. Unfortunately, cautious statements about the future are keeping a lid on the stock. This multinational conglomerate is representative of how earnings season should play out. Soft guidance worries me and profit margins for some companies could suffer since they have not passed on higher costs.

I am long-term bearish, however, I believe we will see a capitulation low soon. If you look at the second chart, you will see that the air pockets we experienced last month are gone. In the last week, we have seen volatile, two-sided trading action and prices are starting to compress. The bulls and the bears are fighting it out and we might be getting close to support. In order for us to find that capitulation low, the market must freefall. An intraday reversal with follow through rallies for two days would mark a significant support level. We might see that low and reversal unfold today.

I doubt that traders will want to hold stocks going into the weekend ahead of earnings next week in the financial sector. Fear is influencing trading and we could see a big drop today. The reversal would set us up for a bounce next week on the actual earnings releases. If you are going to trade this move, you need to have your stocks lined up. Look for situations where support has been established, the stock has maintained a long term uptrend and the stock has bounced during rallies. Biotech looks solid here.

Remember, this is a low probability trade. I am not looking for a sustained rally. Conditions (inflation, interest rates, unemployment, and earnings) are much worse now than they were in April and this bounce will be brief. As soon as the shorts cover, it will be time to get bearish again.

The better play at this juncture is to lighten up on short positions, wait for the bounce and then re-enter.

.

.

.

.

Foreclosure rates spiked by 50% in June (year-over-year) and one out of every 500 homes is now in default. A big round of mortgage resets is taking place right now and higher interest rates could place even more pressure on homeowners.

The Fed has been preparing the market for tightening. A quarter-point rate increase has been priced into September bond prices and another quarter point has been priced in for October. Next week, the FOMC minutes will be released. If they indicate that inflation is the primary focus, the market will have a negative reaction.

Energy prices are placing a huge burden on our economy and they just won't go down. This week, oil inventories showed a much larger than expected draw. The pullback in oil prices was brief over the last week and today we are right back up to $145 a barrel.

Next week, we will get the CPI and PPI. I am expecting to see an increase in the CPI. To this point, the PPI has been climbing faster than the CPI and companies have been absorbing higher costs. This will hurt profit margins this earnings season. Many companies have started to pass those costs on; however, they have cut back on production because higher prices are reducing the demand for their products.

The unemployment rate continues to climb and jobs are the cornerstone for this economy. Last week's Unemployment Report was dismal. We lost 62,000 jobs in June and the numbers for April and May were revised upwards by 50,000. Fortunately, initial jobless claims came in better than expected this week. It is only a one-week number and I would not give it too much weight.

GE announced its earnings before the open and they met expectations. Unfortunately, cautious statements about the future are keeping a lid on the stock. This multinational conglomerate is representative of how earnings season should play out. Soft guidance worries me and profit margins for some companies could suffer since they have not passed on higher costs.

I am long-term bearish, however, I believe we will see a capitulation low soon. If you look at the second chart, you will see that the air pockets we experienced last month are gone. In the last week, we have seen volatile, two-sided trading action and prices are starting to compress. The bulls and the bears are fighting it out and we might be getting close to support. In order for us to find that capitulation low, the market must freefall. An intraday reversal with follow through rallies for two days would mark a significant support level. We might see that low and reversal unfold today.

I doubt that traders will want to hold stocks going into the weekend ahead of earnings next week in the financial sector. Fear is influencing trading and we could see a big drop today. The reversal would set us up for a bounce next week on the actual earnings releases. If you are going to trade this move, you need to have your stocks lined up. Look for situations where support has been established, the stock has maintained a long term uptrend and the stock has bounced during rallies. Biotech looks solid here.

Remember, this is a low probability trade. I am not looking for a sustained rally. Conditions (inflation, interest rates, unemployment, and earnings) are much worse now than they were in April and this bounce will be brief. As soon as the shorts cover, it will be time to get bearish again.

The better play at this juncture is to lighten up on short positions, wait for the bounce and then re-enter.

.

.

.

.

Foreclosure rates spiked by 50% in June (year-over-year) and one out of every 500 homes is now in default. A big round of mortgage resets is taking place right now and higher interest rates could place even more pressure on homeowners.

The Fed has been preparing the market for tightening. A quarter-point rate increase has been priced into September bond prices and another quarter point has been priced in for October. Next week, the FOMC minutes will be released. If they indicate that inflation is the primary focus, the market will have a negative reaction.

Energy prices are placing a huge burden on our economy and they just won't go down. This week, oil inventories showed a much larger than expected draw. The pullback in oil prices was brief over the last week and today we are right back up to $145 a barrel.

Next week, we will get the CPI and PPI. I am expecting to see an increase in the CPI. To this point, the PPI has been climbing faster than the CPI and companies have been absorbing higher costs. This will hurt profit margins this earnings season. Many companies have started to pass those costs on; however, they have cut back on production because higher prices are reducing the demand for their products.

The unemployment rate continues to climb and jobs are the cornerstone for this economy. Last week's Unemployment Report was dismal. We lost 62,000 jobs in June and the numbers for April and May were revised upwards by 50,000. Fortunately, initial jobless claims came in better than expected this week. It is only a one-week number and I would not give it too much weight.

GE announced its earnings before the open and they met expectations. Unfortunately, cautious statements about the future are keeping a lid on the stock. This multinational conglomerate is representative of how earnings season should play out. Soft guidance worries me and profit margins for some companies could suffer since they have not passed on higher costs.

I am long-term bearish, however, I believe we will see a capitulation low soon. If you look at the second chart, you will see that the air pockets we experienced last month are gone. In the last week, we have seen volatile, two-sided trading action and prices are starting to compress. The bulls and the bears are fighting it out and we might be getting close to support. In order for us to find that capitulation low, the market must freefall. An intraday reversal with follow through rallies for two days would mark a significant support level. We might see that low and reversal unfold today.

I doubt that traders will want to hold stocks going into the weekend ahead of earnings next week in the financial sector. Fear is influencing trading and we could see a big drop today. The reversal would set us up for a bounce next week on the actual earnings releases. If you are going to trade this move, you need to have your stocks lined up. Look for situations where support has been established, the stock has maintained a long term uptrend and the stock has bounced during rallies. Biotech looks solid here.

Remember, this is a low probability trade. I am not looking for a sustained rally. Conditions (inflation, interest rates, unemployment, and earnings) are much worse now than they were in April and this bounce will be brief. As soon as the shorts cover, it will be time to get bearish again.

The better play at this juncture is to lighten up on short positions, wait for the bounce and then re-enter.

.

.

Daily Bulletin Continues...