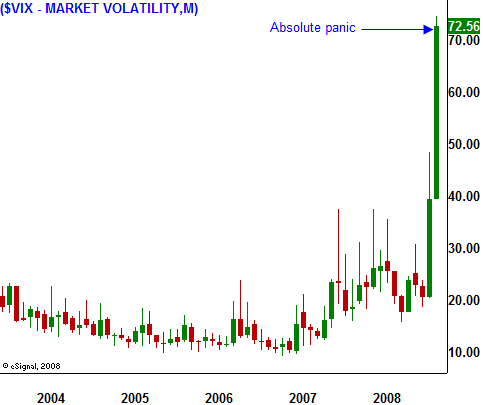

Global Panic – Exit Bearish Positions – Gradually Sell OTM Puts!

There is good news on the horizon. If the market keeps up its current pace, it will stop going down in two weeks. Unfortunately, it will be at zero. I have to keep a sense of humor throughout all of this or I will lose my sanity.

As a subscriber, you know that I have been bearish. However, I did not expect a crash of this magnitude. Overnight, global markets were down from 7-10%. Many exchanges suspended trading.

You can run, but you can't hide. There aren't any safe havens and all stocks are being sold hard. Brokerage firms have raised margin requirements and that is forcing hedge fund liquidation. This means that there are many bargains to be had.

The key is to identify growth companies that have strong balance sheets and good cash flow. It's also important to find companies where customers do not require financing to purchase products. Believe it or not, I've been able to find a handful of solid opportunities and I am selling out of the money puts. These stocks have been resilient during this bloodbath and I'm sell puts that are below a well-defined support level. If support is breached I will buy them in.

Option implied volatilities are at an all-time high and premium sellers are handsomely rewarded for taking risk.

The situation is dire and I am not going to "candy-coat" this as a fantastic buying opportunity. For months, you've heard that from Asset Managers on CNBC. Risk and reward always go hand in hand. The risk is high now and if you keep your wits, you can make some great money while everyone else is running for the exits.

I believe the market will oscillate throughout the day, but it will sell into the bell as it has this week. There is too much damage at this stage and no one will want to hold positions going into the weekend. I am out of all of my short positions and I suggest that you do the same. The risk of a snap back rally increases every day and you don't want to exit short positions once that reversal materializes. Short-sellers will be grabbing at every offer in sight and put premiums will collapse. Your best bet at this stage is to start lining up long positions and sell out of the money put premium on stocks that you would like to buy.

In a matter of a week or two, I expect to see credit markets improve. That change will start to show itself in subtle ways and once the market identifies it, we will rally hard off of these lows.

Daily Bulletin Continues...