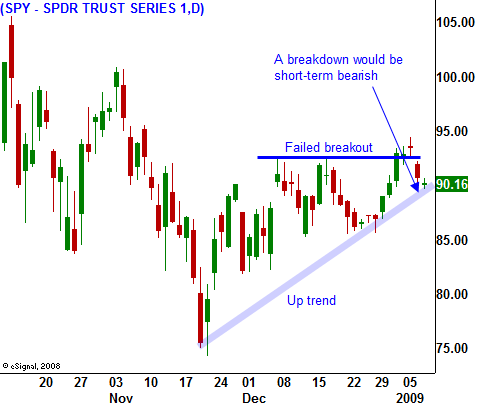

A Breakdown Below SPY 90 Is Bearish – Unemployment Report Ahead!

Over the last few weeks, the market has been able to shrug off weak economic news. It clawed its way back from support at SPY 85 and it broke through minor resistance at SPY 92.

Bulls are putting money to work and spread between US treasuries and junk bonds (the credit spread) is narrowing. This means that the appetite for risk is returning to the market. Hedge funds and individuals have gone to cash and $8.9 trillion sits on the sidelines. Over the last few months, stocks fell more than they should have based on valuation models. The remote probability of a financial collapse was priced in and now those fears have been pacified by the Fed's actions.

The market needed follow-through to challenge the next resistance level at SPY 100. That failed to materialize Tuesday and it reacted to dismal housing data and a big decline in ISM services. Wednesday, the market reacted to the ADP employment index. It showed that 700,000 Americans lost their jobs in the month of December. Once the selling started, the market continued to drift lower throughout the day.

Yesterday's price action was particularly important. Over the last 36 years, as the first five trading days of January go, so goes the year. This indicator has been accurate 86% of the time. If the market closed below SPY 90.70, it would have resulted in a loss over that five-day period. I used SPY 90.70 as a reference because there was a massive sell program in the last few minutes of the last trading day of the year. An equal buy program reversed those losses on the opening bell on the first trading day. In short, the first five days of trading looked like they produced a gain, but in reality we finished where we started.

An uptrend line has formed from the November lows and it rests at SPY 90. Selling momentum could pick up if that trend line is broken. The VIX is starting to climb and uncertainty is creeping back into the market.

Goldman Sachs released their predictions for 2009 and they are daunting. They expect home prices to fall by 15% this year. Banks are projected to lose an additional $1.6 trillion in 2009 and the risk could be that losses are even greater. The government will have to extend more capital to financial institutions. The budget deficit will grow from the current $2.3 trillion level to as high as $5 trillion. The government will have to issue $1.75 trillion in new treasuries to finance the bailouts and stimulus programs. That represents 12% of GDP and that is more than twice the previous high of 6% in 1983.

Today, President-elect Obama announced a massive stimulus package that could cost $1 trillion. Our government will be raising money at a time when other countries are trying to do the same. Yesterday, Germany had a $6 billion bond auction and only two thirds of it was sold. The German treasury had to buy the remaining third and they printed money in doing so. The appetite for government debt is waning. China has traditionally spent one sixth of its GDP on foreign debt and it stated that it is no longer going to do that. It needs to finance its own stimulus package. This will greatly increase the cost of capital as the US tries to fund its programs. A few weeks ago, Standard & Poor's warned that the United States could lose its AAA bond rating if the budget deficits continue. This would dramatically increase the cost of our programs.

There are a handful of positives and a mountain of negatives in the current marketplace. The long-term trend is on the downside and these issues will take years to resolve. If the market breaks below SPY 90, I will start writing out of the money call credit spreads on weak stocks that have bounced during the recent market rally. Daily Report subscribers are armed with an arsenal of weak stocks to choose from. Once the market regains support, implied volatilities will be rich and we will sell out of the money put credit spreads on stocks that have firm support levels. This is the best strategy for this market and it is working well.

A big market decline on Thursday will price in a horrible number on Friday. I expect unemployment to be very high and the rate of acceleration is faster than economists had forecasted.

Daily Bulletin Continues...