If The Market Does Not Make A New Intraday Low – Sell OTM Put Spreads!

The market is remarkably resilient at its current level. The horrific ADP employment index only prompted one day of selling. Yesterday's initial jobless claims came in better than expected. However, many analysts feel that unemployed workers did not file for compensation during the holiday and that those claims will be reflected in next week's number.

As feared, the unemployment rate skyrocketed to 7.2% in the month of December. That is the highest rate in 16 years and the economy lost 524,000 jobs. This is the 12th straight month of job losses and the total for 2008 was 2.6 million. Many analysts projected that the rate would rise to 8%, but no one expected unemployment to climb so quickly. November's unemployment number was raised and that added to the spike in the unemployment rate. I believe we will see double-digit unemployment in 2010.

As long as the market feels that the chance of a financial collapse is minimal, there's a chance for a rally. Prices moved higher after the release this morning, but the bulls got ahead of themselves. Today's close will be particularly important.

The market has established support on an intraday basis and I feel we might see a rally into the close. If we make a new intraday low, we won't get the afternoon bounce.

Next week earnings start to dribble in, but they won't really get going for another 10 days. A variety of economic numbers will be released during the week and they include retail sales, CPI, PPI, industrial production, initial jobless claims and the Philly Fed. Out of all of those numbers the initial jobless claims has the greatest potential to surprise on the downside. The market has been able to shrug off all of the other bad economic data and I don’t believe these numbers will move prices.

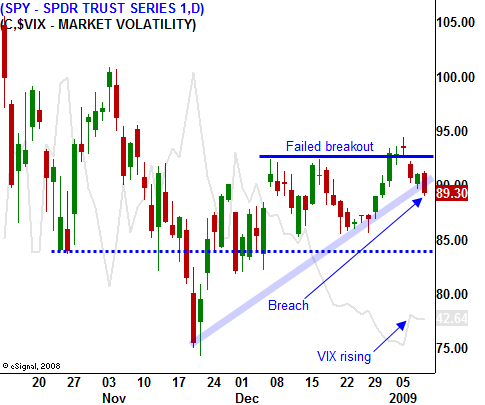

It is critical for the market to maintain the uptrend line that has formed since the November low. The trend line rests at SPY 90 and as I write this, the market has breached that level.

Next week is option expiration and if we stay in the middle of the one-month range, program trading should not have a material impact. If we drift down to SPY 85, selling could kick in. Conversely if we rally above SPY 92, buy programs could kick in.

I believe that there is a bit of euphoria ahead of President-elect Obama's inauguration. Credit spreads (the differential between US treasuries and junk bonds) are narrowing and that is a good sign. It shows an appetite for risk. Investors have $8.9 trillion in cash on the sidelines and we are seeing some bargain hunting. That has resulted in a bid to the market.

If we do not establish a new intraday low by 2:00 PM central time, take advantage of this dip and sell out of the money put credit spreads. I am confident enough to sell January spreads as long as the stock has held up well and a firm support levels exist.

Daily Bulletin Continues...