Earnings Will Support The Market Today – Sell OTM Puts and Put Credit Spreads!

Yesterday was one of the strangest days I can recall. On one hand, you had a nation celebrating the inauguration of a new President like never before. Hope and optimism electrified the nation. On the other hand, the issues confronting our new President caused the market to plunge.

Financial stocks have been releasing earnings and the outlook is grim. A few weeks ago, Goldman Sachs forecasted that $1.6 trillion of new capital would have to flow into financial institutions to keep them viable. They also stated that this was a conservative estimate. Now it seems as though they were correct.

The list of casualties as long, but here are a few highlights. In Europe, Deutsche Bank announced a $6 billion loss. Speculation has it that HSBC will need a $30 billion capital infusion. Barclays stated that they will hit their number, yet the stock was down 70% in a matter of days. In the US, Citigroup is selling its most valuable asset (Smith Barney) and many analysts think the stock will be nationalized. Bank of America is choking on its acquisition of Merrill Lynch. Brokerage executives are leaving Merrill and the company lost $15 billion last quarter. Analysts are speculating that Bank of America will need an $80 billion infusion. The regional banks have weathered the storm fairly well to this point. However, Regions Financial and PNC have reported huge losses. The credit crisis continues to spread.

The financial sector has to stabilize before a sustained rally can unfold. From a market capitalization standpoint, financial stocks previously accounted for 20% of the S&P 500. Now they account for 10%. Before all is said and done, that percentage will decrease. It is more and more apparent that the government will take a larger equity stake in these firms. Financial stability is the cornerstone to economic growth and businesses need free-flowing credit to operate.

One of my many concerns is that the sponsorship for all of our debt will subside. The TARP money will be gone in a flash at this rate and a $1 trillion stimulus package is waiting in the wings. Analysts project that the US will need to issue close to $1.9 trillion in new debt this year. That is 12% of GDP and is twice as much as the prior high in the early 1980s. To date, we have only raised about 10% of the total. Last week, Germany had a $6 billion bond auction. Only two thirds of it was placed and their treasury had to buy the remaining third. When governments buy their own treasuries they are “printing money”. This indicates that the demand for German debt may have reached a limit. When the demand for new debt reaches a limit, the cost of capital increases dramatically.

The economic news this week is fairly light and initial jobless claims and housing starts will be released tomorrow. Next week, the FOMC meets. The Fed Funds target is 0% and they are out of bullets. Any statements they make are not likely to drive the market. Right now, we are in earnings mode and those releases will drive the market.

Yesterday, IBM released decent earnings and that provided a springboard this morning. Outside of the financial sector, the earnings are in line and the guidance has been conservative. After the close tomorrow, Google will announce. This will shed light on the entire advertising industry. Next week, we will see how willing hospitals are to invest in new equipment after Intuitive Surgical releases earnings. General Electric will shed light on global capital expenditures and Slumberger will reveal the demand for oil services.

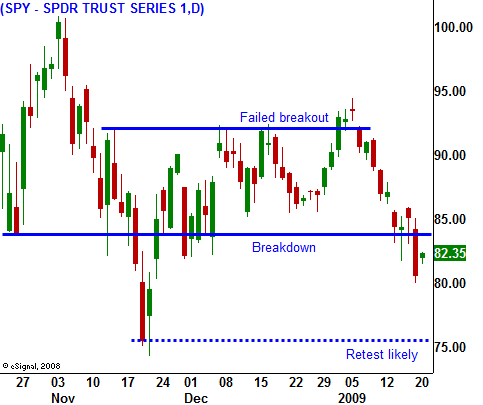

The market has broken key support at SPY 85 and there is no reason to be bullish. Major support is close by and with the high implied volatilities it does not make sense to enter bearish positions either. Many financial institutions will be releasing earnings over the next few days. After a horrible session, the market is trying to tread water. The advance/decline is barely positive (4:3 margin) and I expect a relatively quiet day today. I am gradually starting to sell out of the money puts on stocks I like. Focus on companies that have released earnings and have held up well recently. Scale in and expect to see more market weakness.

Daily Bulletin Continues...