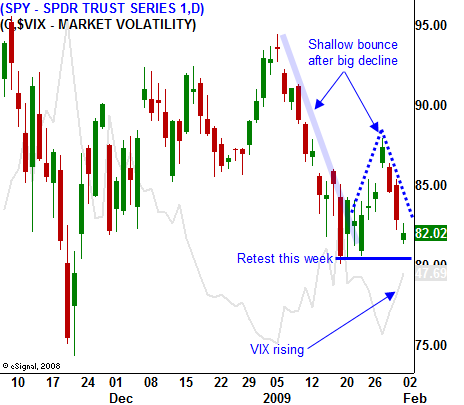

The Selling Pressure Will Increase This Week – SPY 80 Will Be Tested!

This morning, the market is continuing its nasty slide from last week. In the chart you can see the shallow bounce that followed a big decline. This is a bearish sign and we can expect to retest support at SPY 80 this week.

Negative economic news continues to weigh on the market and uncertainty is reflected in a rising VIX. Traders will play it safe ahead of Friday's Unemployment Report. Wednesday, the ADP Employment Index will be used as a gauge. Last month, they revised their calculations and their number showed more unemployment than the actual Unemployment Report. This is unusual since ADP has been known to show more employment than the actual results. Thursday, initial jobless claims will also be used as a barometer for Friday's number. It has been typical for the market to sell off before the release. The number has been very weak during the last year and the reaction on Friday has been muted because worst-case scenarios were priced in ahead of time.

This morning, overseas markets were down 1.5% on average and they cast a cloud on early trading. Global chip sales fell 22% in December as reported by the Semi-conductor Industry Association (SIA). The declines were broad-based from autos, to PCs, to cell phones. ISM manufacturing fell less than expected, but the number was still a very weak 35.6. A number below 50 indicates economic contraction. Personal spending fell by 1% in December and for all of 2008 it increased by 3.6%. That is the lowest level of personal spending since 1961. Personal income fell .2% in December and as people make less, they will spend less.

Earnings before the bell included AMD, ROK, MAT, HUM and PJC. All of the results missed estimates and the stocks were down on the open. Earnings this afternoon and tomorrow morning include AFL, MAN, and UPS. I will watch these stocks in particular. AFL will shed light on the insurers, many of which will release later in the week. MAN will shed light on the employment scene and traders will try to front run Friday's number. UPS is a barometer for economic activity and the guidance will give traders an idea of what to expect in Q1.

The market has rebounded nicely from its earlier lows this morning. Beginning of the month buying might be helping it tread water today. As the week progresses, selling pressure should push the market down to SPY 80. If that level fails with ease, we will retest the lowest from November in the near future. On the other hand, if SPY 80 holds, there is a chance we will see a bounce.

I expect the market to hold up today. I am not selling any new put positions and I have 75% of my desired risk exposure at this stage. I want to get through this week before I add to my positions. If the market breaks below SPY 80, I will reel in any short puts if the stock has also broken support.

Daily Bulletin Continues...