Don’t Read Too Much Into Today’s Bounce From Deeply A Oversold Contition!

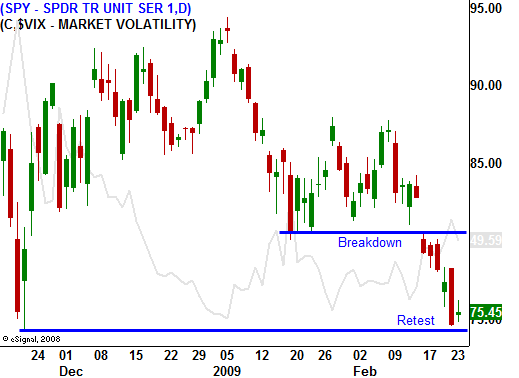

The market is trying desperately to recover from yesterday's deep decline. The November lows were tested and for the time being, this level is holding. The market made new 11-year lows yesterday and the rally this morning is half-hearted.

Yesterday afternoon we learned that AIG would post the largest quarterly loss by a corporation - ever. In the last quarter they lost $60 billion. That is in addition to the $100 billion they lost last year. When this all started, I remember them needing an $80 billion "bridge loan" until they could sell some assets. The government has already sunk $180 billion into this company and now it needs more to survive.

This is one example of how deep the financial crisis is. Financial institutions are all interdependent and one failure could send a shockwave through the system just as Lehman did. Fear is elevated and traders can't help but wonder how much more money will be needed by other financial institutions when they start liquidating toxic assets.

Speaking of bailouts, we also know that the Big Three came back for another round of funding. AIG had to be saved because a failure could jeopardize the entire financial system. Automakers had to be saved because they represent the only manufacturing left in this country. Every politician knows that automakers will be back for more and that economic conditions will be much worse than forecasted.

The states are also lining up for bailouts. It is unconstitutional for them to run deficits and they can't balance their budgets. We've all heard about California, New York and the upper Midwest, but when a state like Kansas can't meet its payroll, you know the problem is widespread.

As I've been mentioning, all of the silver bullets have been fired. There is truly nothing else that can be done. Interest rates are at 0% and we are testing our ability to sell treasuries. As a percentage of GDP, our deficit is twice as high as it has ever been. Additional talk of stimulus or bailouts will not rally the market since we don't know if we can raise enough to meet our current needs.

The market is resting today and it is clinging on to gains. This oversold condition should result in a small bounce, but the news has been so dire that buyers are not taking any chances.

The earnings this week include retailers, REITs and utilities. The news and guidance has been dismal and nine out of ten sectors have missed testaments. The economic news has also been bleak and durable goods, GDP and initial jobless claims will not provide a spark. Consequently, this market is likely to work off its oversold condition for a few days and then head lower. End-of-month buying might also lend a little support this week.

There simply isn't any good news to spark a short covering rally and economic conditions continue to deteriorate. The market will decline in an orderly manner on decreasing volume over the next few months. This is because buyers are pulling bids and sellers are not overly aggressive. The fact that we were easily able to penetrate major support tells me that support will not hold much longer.

There are still pockets of strength and I will start selling naked puts on a handful of stocks this week. I do not expect a string of huge down days since much of the selling has already transpired. The market has not given bulls any hope and the handful of optimists that tried to pick a bottom were shaken out over the last few days. This means the panic selling is over.

I still believe that selling out of the money puts is the best strategy. In a controlled decline, I can adjust my positions. As time elapses, the time decay and volatility decline provide a cushion. Violent snapback rallies are what I fear the most and that is why I am not selling call spreads. From deeply oversold conditions, this market could rally 20% in a matter of days.

Daily Bulletin Continues...