Gradually Start Selling OTM Put Options and Put Credit Spreads!

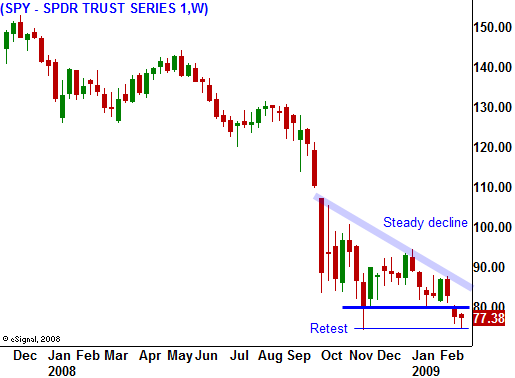

The market has been able to hold the 11-year support level this week. It is rallying from deeply oversold conditions after testing SPY 75. Unfortunately, this short-term rally will soon run its course.

With short-term interest rates effectively at zero, earnings and economic news will determine market direction. The Fed has done all it can. The government is also tapped out and we don't even know if we can raise enough money (at a reasonable cost of capital) to fund our existing stimulus and bailout plans.

On the earnings front, 90% of the sectors have missed earnings estimates this quarter. Those companies that haven't revised their 2009 projections are back-loading Q3 and Q4. That potentially sets us up for warnings later in the year. Regional banks had been spared from the credit crisis until last quarter. Massive write-downs are taking place and this quarter is likely to be at least as bad for regional banks. Insurance companies are taking a beating on their investments and another failure could be right around the corner. This week, we learned that AIG lost $60 billion. That is the biggest quarterly loss by any corporation ever. GM is doing its best to challenge this record. Last quarter it lost $9 billion. It burned through $6 million in cash. Citigroup needs more funding from the government and they are trying to structure a deal.

Today's durable goods number showed a 5.2% drop in orders. Business spending was down 5.4% and that speaks volumes about their expectations for the future. Last month business spending was revised downward by a huge margin. Initially, a 3.2% decline was reported and today it was revised to -5.8%. Businesses like individuals are tightening their purse strings.

Initial jobless claims rose to 667,000 when 625,000 was expected. Continuing unemployment claims rose to 5.1 million, an all-time record. The acceleration in unemployment leads me to believe that we could see double-digit figures this year. The highest estimates I've seen from economists are 9%, but I believe conditions are deteriorating faster than we’ve ever seen. I also do not believe the stimulus plan will create 3 million new jobs and I do not believe it will save 6 million jobs. Last year’s tax rebates were saved not spent. A large percentage of the stimulus is dedicated to helping the poor and the unemployed. While a noble gesture, it does not create jobs.

Americans are struggling and they are cutting back on consumption. Credit card defaults rose 40% year-over-year to the 8% level. People are nesting and anyone who entertained selling their house has given up. Home inventories stand at 342,000, a five-year low. That might sound promising since some of the inventory needs to be worked off. In reality, there are more than 13 months worth of inventory and that is a record high.

The earnings are horrible and the economic conditions continue to deteriorate. This means that any rally will be short-lived. We won't see a sustained move until economic conditions improve. I believe the first signs will come in the way of higher commodity prices. China is likely to be the first country out of this mess and when they start consuming, commodity prices will rise. The move needs to be gradual and sustained. Don't be fooled by short covering rallies.

With all of the new spending, the dollar will get crushed as our national debt level escalates. Commodity prices will rise on that alone and it will be important to gauge commodity prices based on the yen (not the dollar). It is currently one of the strongest currencies.

There is money on the sidelines and it is ready to be placed. Investors are cautiously nibbling when the market tests the low-end of the range. Buyers are not chasing stocks and they do not believe that they are going to miss the next big rally. After a brief rebound, the sellers come back in. That is exactly what we are seeing this week.

Next week's Unemployment Report should be horrendous. However, shorts that have sold stocks ahead of the release have been squeezed two months in a row now. I believe we could test SPY 75 again next week, but that support will hold. Investors have been programmed to expect the worst and they are taking it in stride. Consequently, I believe selling out of the money puts on very strong stocks is still the way to go. The big nasty drops have played out for the time being and we won’t see any unless we have a big rally first. I have been entering naked put positions this week and I will have 50% of my desired exposure next week. If SPY 75 holds after the Unemployment Report, I will sell more puts. That will take me to within two weeks of expiration and I feel that the market should be able to "mark time" until option expiration.

Today, look for steady trading on the plus side.

Daily Bulletin Continues...