Look For A Pullback Next Week – Get Long After the Unemployment Report!

Yesterday, the market rallied after decent earnings were released from a small number of companies. Signs of life emerged from the retail sector and those stocks surged higher. Tech stocks also rallied into positive territory for the year.

Bulls appear to have the upper hand. A late day decline on Wednesday was squashed during the waning moments of trading and the market closed on the plus side. That bullish momentum carried into trading Thursday morning and the market was able to climb higher the entire day.

Analysts can spin numbers anyway they want. Durable goods orders were slightly better than expected, but they were still dismal. New home sales were up month-over-month, but they were still the second worst ever seen. Furthermore, January's home sales were revised sharply lower. Home prices also continued to plunge by 18% year-over-year. Those statistics were not quoted, because everyone wanted to focus on the positive. GDP declined by 6.3%, the worst showing in 25 years. However, more attention was placed on the fact that it came in better than the expected 6.5% decline. Initial jobless claims rose to 652,000. Continuing claims jumped to 5.56 million, much worse than expected. All of these factors were disregarded or twisted in a positive manner.

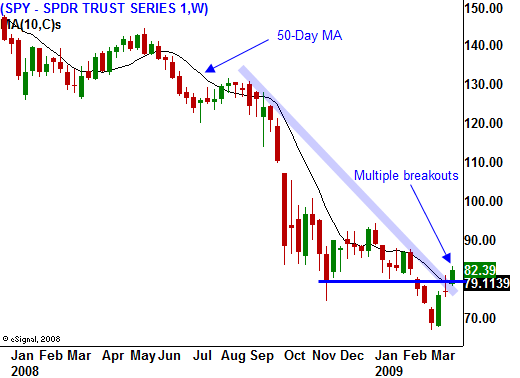

I like the fact that we have a nice two-week rally behind us. Consumer sentiment is improving and perhaps the lows from a few weeks ago will hold longer-term. As for this bull run, I believe it will run out of steam in the next week. The Unemployment Report will scare many bullish speculators out of the market and we will see a pullback Wednesday and Thursday. A higher low will be established and the market will be able to stage another rally.

The bottom line is that the market wants to rally, but don’t be fooled into thinking that conditions are improving quickly. They are not!

All of the stimulus created by the Fed and Treasury will start to take root. The party is just starting and people are lining up at the punch bowl. It's possible that we will see a rally that could last a few months. However, in the not too distant future, the oversupply of US Treasuries will reach a saturation point and interest rates will climb. This week, we already saw that in the UK. England had its first failed bond auction since 2002 and the $1.7 billion pound offering was under-subscribed. We have $2 trillion in debt to issue and we are just getting started.

By late summer, the consequences of our bailout and stimulus plans will start to weigh on the market.

For now, let's enjoy a bear market rally. The concept will be to buy the dips and sell the rips. We have to be cautious in doing so because we are trading against the long-term downtrend. Selling out of the money put spreads is another way to play this. However, as the market rallies, the implied volatility will drop and the strategy won't be as effective a few months from now.

Apart from being overbought, the market really has no reason to sell off today. We have lost so much equity in the last year that is hard to classify this market as overbought. End of month/beginning of month fund buying will support the market today and I expect a rebound. Monday and Tuesday should also be positive. This is also the end of the quarter and we can expect "window dressing". The pullback I am forecasting ahead of next week's Unemployment Report will present a buying opportunity.

Retail stocks have been holding up well and commodity stocks are also moving higher. I like selling out of the money put spreads on those stocks and if we do get a nice pullback, I might even consider buying some calls for the first time in months.

Daily Bulletin Continues...