This Rally Will Continue Into the Close – Next Week Looks Bullish!

Last week the market staged a nice rally and it briefly poked above the 100-day moving average. It has been able to find the silver lining in every dismal economic report.

The Fed, Treasury, FASB and SEC have all been busy in the last month. Traders do not want to go home short because they don't know what news might change the landscape when they turn on their computers Monday morning. They won’t go home short today and this rally should last into the close.

The Fed has lowered the Fed Funds Rate to zero and it plans to keep interest rates low even if it means buying US Treasuries. The Treasury Department has been busy with bailouts and stimulus plans of all sorts. Recently, they devised a plan to purchase toxic assets from banks to free up capital. FASB relaxed mark to market regulations and that instantly improved bank balance sheets. This week the SEC reinstated the uptick rule and is considering other short-selling circuit breakers.

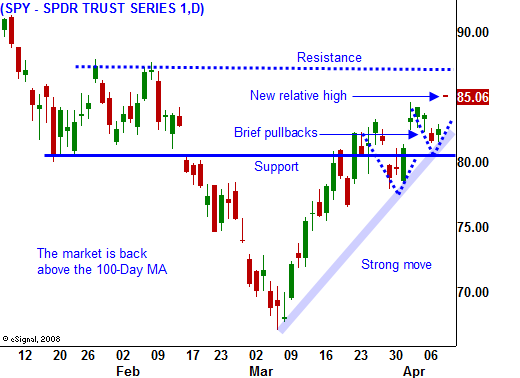

From the 12-year lows made a month ago, the market has rebounded sharply. In today's chart you can see that it is above horizontal support and it has moved above the 100-day moving average. A new relative high has been established and each of the pullbacks has been very short-lived. Bears are running for cover and a short squeeze is underway.

I expect this rally to continue next week. Today, Wells Fargo surprised the market by pre-announcing earnings. It estimates a $3 billion profit during the first quarter of this year and it expects EPS of $.55. Next week, we will hear from the strongest of financial stocks. Goldman Sachs, J.P. Morgan and General Electric will release earnings. Goldman Sachs has a history of surprising to the upside. J.P. Morgan has weathered the financial crisis better than any of the other major banks. GE stated two weeks ago that if the Fed's 2009 economic forecast holds true, GE Capital will make money this year. Any sustained rally must start with the financial stocks.

The spread between borrowing and lending rates has never been better and banks should be making money hand over fist. Before we get too excited, it's important to remember that massive write-downs lie ahead. It will take many years of profitability to overcome the toxic assets they have created. Nevertheless, signs of improvement are showing up and they are critical to the economy. Businesses might finally regain much needed lines of credit.

Today's rally should continue right into the closing bell. This is clearly good news and shorts are covering. The market is near a one-month high and option expiration buy programs will add a bullish bias to the market next week. Bears don't dare to short financial stocks ahead of earnings releases after Wells Fargo's announcement today. If the momentum establishes itself early next week, I believe we could rally up to SPY 92.

We will also hear from Intel, Google and Johnson & Johnson next week. Dismal earnings are already factored into Intel's number and if anything, we could see a rally in the stock on positive guidance. Google has been able to post good numbers and I expect the same next week. Johnson & Johnson has been profitable, but shares have been beaten down on concerns that healthcare reform will impact future income. The actual release should be positive for the stock.

Next week is littered with economic releases. I don't want to downplay them, but the market has been able to rally in the face of dire news. This morning, initial jobless claims dropped 20,000 from last week's number. The unemployment rate continues to climb and 5.83 million Americans continue to draw unemployment benefits. This is the highest number ever. The market shrugged off weak durable goods orders, a decline in GDP and a horrible Unemployment Report. There's no reason to think that CPI, PPI, the Beige Book or the Philly Fed will be able to suppress this rally next week.

This morning, retail sales also added fuel to the rally. As I look at the numbers, I don't see much to cheer about. Many stores beat lowered estimates and the results are still very weak.

This rally has legs and I suggest selling April put spreads that are near the money. You can take advantage of time premium decay and a collapse in volatility. I don't want to buy calls until the VIX drops below 30. Retail, restaurant and commodity stocks all look good.

In the back of your mind, remember that this is a bear market rally and that you need to temper your optimism. Our government is $11 trillion in debt and it has not started financing the trillions of dollars it needs for the proposed bailouts and stimulus plans. The unemployment rate continues to surge and we are not out of the woods. Trade this rally, but be cautious and take profits!

Daily Bulletin Continues...