The Market Should Find Support Today – Look For A Higher Close!

As I mentioned yesterday, this is the calm before the storm. Light holiday trading has set in and we are in a news vacuum until next week. There just aren't many stories to drive the market.

The SEC will be voting on new short sale rules today. They might reinstate the uptick rule and a variety of circuit breakers. That could be deemed as good news for the bulls. This morning we learned that TARP might be extended to insurance companies and that helped to boost the financial sector.

I believe the market will find its footing this week. It needs to do so or bears will gain the upper hand heading into option expiration. Worst case scenarios are expected for tomorrow's initial jobless claims number. Any improvement could spark a rally in this light trading environment.

As I outlined yesterday, I believe the earnings news will be pretty decent next week. Goldman Sachs, J.P. Morgan and General Electric have all made positive statements recently and they are the strongest stocks in the financial sector. We will also hear from J&J, Baxter, Intel and Google. With the exception of Intel, I'm expecting decent results. Semi conductor sales have been down and bad news is priced in.

A nice rally to the 100-day moving average could spark option expiration buy programs and a short covering rally could result. If that move materializes, it will set up an opportunity to sell out of the money call spreads after expiration. As other financial stocks release earnings in the coming weeks, I believe the market will pull back. Many banks have stated that March was not as good as the first two months this year. Many write downs can also be expected and financial stocks have rebounded nicely in the last month. This sets us up for earnings disappointments.

In February, all of the news and the momentum were one-sided. That has changed and we now have opposing forces. Bulls are eager to put money to work and they feel we have reached a trough. They say that conditions are improving and that economic releases do not reflect current activity. Bulls also feel that the Fed/Treasury initiatives are bearing fruit. On the other hand, bears view this rally as a bounce to an oversold condition. The damage from the credit crisis runs deep and it will take years to resolve.

From a trading perspective, I believe we will establish a wide range and the market will oscillate back and forth from one end to the other in the coming months. I see many great values in the market and I still favor selling out of the money put spreads.

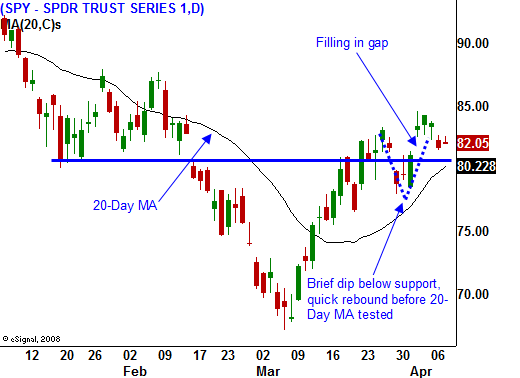

If the market is going to challenge the high from last week, it needs to get going soon. Today would be a good start and advancers led decliners by a 2 to 1 margin. A rally into the close would set us up for a nice rally Thursday and Friday. Bears have not wanted to go home short over the weekend because they don't know what the Fed or Treasury might do next. This week should be no different.

Asian markets were down substantially overnight and that might provide a bit of a drag. Otherwise, there's no reason why we can't post decent gains today. I am selling out of the money put credit spreads on stocks I like. I expect the market to quiet down in the next few days and I want to take advantage of light holiday trading and time premium decay. By the time we get back next week, we are only days away from option expiration.

Daily Bulletin Continues...