The Market Has Been Able To Shrug Off Swine Flu – Still A Time For Caution!

Yesterday, the market reversed by mid-morning and the Swine Flu scare pushed prices lower. As I suspected, that the muted reaction was a bit too casual. The virus is spreading around the globe, but outbreaks in the United States seem contained for the time being.

Confidence has returned to the market and buyers are viewing this dip as an opportunity. This morning, consumer confidence rose to 39.2, up from 26.9 in March. This is the highest reading since November. Home prices continue to decline, but at a slower rate. Year-over-year, home prices have declined 19%.

Bulls are shrugging off economic data on the notion that it is backwards looking and it does not reflect current conditions. I take issue with that view and I believe bulls are a bit ahead of themselves. If we were in the midst of a turnaround, companies would be providing guidance and they are not. More than 25% of the companies in the S&P 500 have released earnings. More than two thirds have exceeded lowered estimates. However, analysts expect Q1 profits to drop by 34% and Q2 profits to drop by the same percentage.

Next week, the government will release the results of its "stress test". It is rumored that Bank of America and Citigroup will need to raise capital. That release will be critical and we can expect choppy trading.

There are many economic releases slated this week. They include GDP, initial claims, personal income, Chicago PMI, factory orders, and ISM manufacturing. The market has been able to take economic releases in stride and I believe it will do so again.

Tomorrow, the FOMC will release its statement. The last time they met, they announced a quantitative easing program that added $1.3 trillion to their budget. With the threat of Swine Flu pushing consumers into a nesting mode, the comments are likely to be very accommodative.

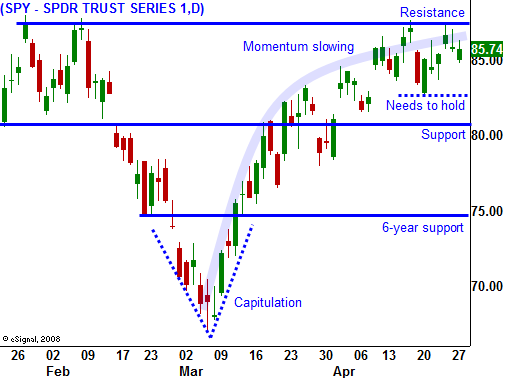

The market wants to push higher, but the easy money has been made. As it continues to move higher from here, it will hit formidable resistance levels. As a result, I am playing it safe by selling out of the money put spreads and out of the money call spreads.

I am watching treasury yields very closely. Yesterday's bond auction went well. There was a flight to safety into bonds because of the Swine Flu threat. I am not as optimistic about future auctions and I believe interest rates will push higher. This will provide a stiff head wind for the market.

For today, advancers led decliners by a 3 to 2 margin. The market was able to hold its ground yesterday and there's a good chance it will creep higher this afternoon. It is possible that the Swine Flu outbreak is nothing more than a scare, but I'm not prepared to dismiss it. If it spreads quickly and the fatalities grow, it could have a devastating impact on our economic recovery.

There are many crosscurrents at this juncture and you can expect choppy, directionless trading through next week. The VIX is still elevated at 38, and premium selling strategies make the most sense.

Daily Bulletin Continues...