Reaction To Swine Flu Too Casual – Watch For A Decline – Be Defensive!

Last week, the market started off on a very weak note and the S&P 500 declined more than 30 points on Monday. It spent the rest of the week recovering those losses.

Friday, the market staged a strong rally right into the closing bell and it seemed to like the information regarding the government's "stress test". Rumors have been floating around that only one of the nineteen banks will need to raise additional capital. Those results will be released officially on May 4.

The government wants to release these results to improve transparency. New capital needs to flow into financial institutions and they feel that this report might instill confidence. The reality is that private equity does not want to invest in financial institutions when the rules of the game are continually changing. Last Monday's decline came on the heels of statements made over the weekend that the government might convert its TARP loans into common shares. That would make them the largest shareholder and it is one step away from nationalization. Investors did not endorse the “new idea”.

The "stress test" can be candy-coated and Wall Street will see right through it. The government is not going to release a dire report when all of their efforts have been focused on stabilizing financial institutions. I expect a favorable outcome and a muted market reaction.

Last week, Bank of America and Capital One stated that the financial crisis would get much worse before it gets better. Credit card defaults are projected to hit 10% soon.

This morning, Swine Flu is the major concern. Over 100 deaths have been reported in Mexico and young healthy people have been part of that death toll. Cases in the United States and Europe are springing up. The United States declared a public health emergency and leisure travel to Mexico is highly discouraged.

After the initial decline this morning, the market recovered quickly. It remembers the recent SARS scare that turned out to be nothing. I don't know how this epidemic will play out, but the market's casual reaction to the news tells me that this is being viewed as a non-event. Investors will need to see concrete evidence that the flu is spreading quickly before they get scared.

If we do see a decline this week, I believe it will reflect overall weakness (not just a Swine Flu reaction) and profit-taking from an overbought condition. Throughout the week, we will have many economic releases and an FOMC meeting. Bulls are discounting economic data on the notion that it is stale information that does not reflect current conditions.

Over 25% of the S&P 500 companies have reported earnings and I believe the market knows pretty much what to expect from each sector. The big tech names (Google, Yahoo, RIMM, Microsoft, Apple, and Amazon) have all announced and I believe we've seen most of the "firepower". The corporate guidance for Q2 was not particularly strong and I believe the bulls are ahead of themselves. At very best, conditions have bottomed out, but they are not improving.

The most interesting news this week will come from the bond auctions. The Treasury will issue many new bonds this week and interest rates have climbed back to resistance. That level was established two months ago when the Fed announced that they will buy treasuries to keep interest rates low. This is the same as printing money and it should be used as a last resort. We have barely begun to finance our huge bailout and stimulus plans. If the Fed needs to play that trump card this early in the game, it does not bode well for the future.

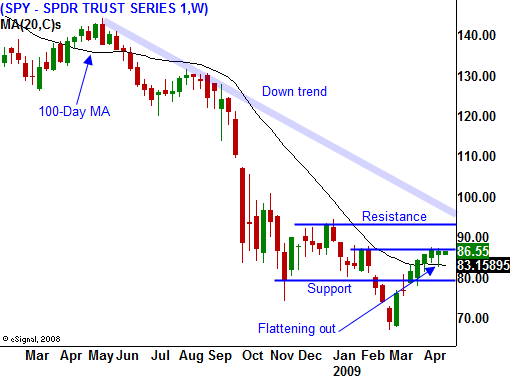

We have been able to rally above the 100-day moving average and it is flattening out. That is a bullish sign and the dips have been very short-lived. During all of the recent upside momentum, it's easy to forget that we are in a bear market. In today's chart you can see that major resistance lies at SPY 92.

I believe we will establish a trading range this summer and things will quiet down. There are opposing forces and that means that we will chop around. I am forecasting a range from SPY 80 – 92.

For today, I believe the market will decline late in the day. Swine flu is here in the States and pathologists are forecasting that it will spread. SARs never really made it over here, but this is different. As conditions worsened, investors will grow nervous. I sold OTM put spreads last week and I am currently establishing OTM call credit spreads. Hotels, gaming (travel in general) are my favorite areas. As the flu spreads, people will avoid public places.

Daily Bulletin Continues...