The Market Has Run Out Of Steam – Look For A Pullback!

Yesterday, the market tried to regain its footing after a nasty decline on Monday. Shortly after the open, small gains were erased and selling took hold. Throughout most of the day, the market tested the downside. A late afternoon reversal represented a victory for the bulls and they were able to mitigate the damage.

This morning, the market is weak again. Retail sales dropped .4% when analysts were looking for flat results. Last month’s number also disappointed, but the market was able to shoulder that news while it was in rally mode.

As I mentioned in yesterday's comments, consumers are cautious. They don't know the status of their job and they will not spend until they have confidence. The same holds true for mortgages. Mortgage applications fell last month and 70% of them were refinances. The rate at which Americans are losing their jobs has slowed, but the fact remains that unemployment is rising.

Corporations are taking advantage of this market rally and they are issuing shares of stock like mad. While this is prevalent in the financial sector, it includes all companies that are overleveraged. The supply of new shares is dilutive and it has contributed to the market decline in the last few days.

The White House estimates that their budget deficit this year will be close to $2 trillion. That represents 13% of GDP, twice the level seen at the prior peak in the early 80s. This morning, President Obama pledged that major strides would be taken to implement national healthcare reform by year-end. The cost of his programs will be monumental and taxes will have increase substantially.

The supply of hospitals is decreasing and many are on the brink of closing. They can't collect for treatment and their receivables continue to grow. The number of physicians is also constant and to a large degree it is controlled by the AMA. Given the amount of time it takes to become a doctor, this won't change anytime soon. With the number of health-care recipients due to increase, the quality of healthcare will go down dramatically for anyone that currently has it.

Anytime the government has a "better way" I'm skeptical. The government can't and won’t figure out healthcare. They can’t even balance their own budget. Baring a few years under the Clinton administration, they have run deficits every year for decades. The government can't even run the United States Postal Service profitably. FedEx and UPS demonstrate that the private sector is much more efficient and that there's money to be made.

Every day, it’s something new. Now the government wants to regulate pay across the entire financial industry. That includes regulated hedge funds and private equity firms that have not taken a dime from the government. This scares the hell out of me. Why stop there, let's lower the pay for every actor/actress to $100,000 per movie – that seems reasonable. That would go over well with Obama's Hollywood constituents. Let’s also cap the amount of money and author can make. The government should be able to figure out a fair wage for “The Audacity of Hope”. They have no right regulate the pay of those employed by private entities (that have not taken a dime form taxpayers). People who have money invested with hedge funds and private equity can vote with their feet if they don't like the compensation.

I'm getting a little off topic, but these issues are weighing on the market. Every day there is a new plan on how the government is going to run our lives!

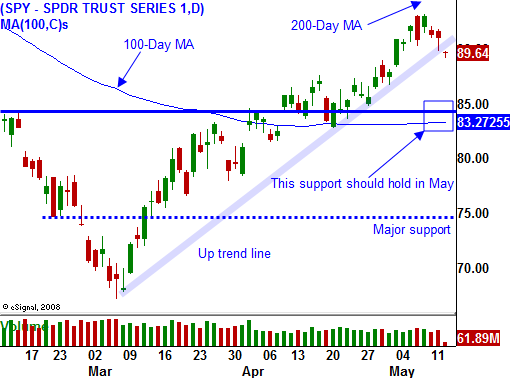

We've had a nice two month run and the market bounced sharply from an oversold condition. It stalled before it could challenge the 200-day moving average. That could have sparked major short covering, but when it failed to happen this week, the bears took charge.

A lot of the wind has been taken out of the market's sail. Financial stocks have stabilized and the stress test added transparency. They have been able to raise capital and time will help them heal. However, these stocks have rallied dramatically off of their lows and the dilutive nature of new offerings will keep a lid on this sector. Technology stocks have also stalled and news of the EU's antitrust fine against Intel should weigh on those stocks. Retail stocks have also rebounded sharply and today's retail sales figure will keep them in check.

In short, the market is out of catalysts. On the negative side, interest rates keep creeping higher as the treasury starts to fund the bailout and stimulus plans. The market will rollover and I am neutral at this juncture. I believe SPY 85 will hold if interest rates stabilized at this level. I am selling call spreads on retail and defense and I am selling put spreads on commodity stocks.

I believe today's decline will continue into the bell. Decliners outnumbered advancers by 6 to 1. The economic news the rest of the week won't stand in the way of this decline and option expiration could accentuate the move.

Daily Bulletin Continues...