Yesterday’s Reversal Is A Sign Of Weakness – Scale Into Short Positions!

After an extended holiday weekend, the market shot higher Tuesday after consumer confidence beat expectations. It made its largest jump in over six years. The S&P 500 rallied 26 points and it closed on the high of the day.

Almost 70% of our GDP is derived from consumption and this improvement is critical to an economic recovery. It indicates that Americans are feeling better about their prospects. Before we get too excited, let's keep our perspective. Two months ago, people were burying gold in their backyard and buying guns to protect it. We were on the brink of a financial collapse and fear was as high as I've ever seen it. Now that some stability has returned to the financial system, confidence has improved. That spike in consumer confidence was from the depths of despair. Consumers are cautious and they are not going to resume their reckless spending habits.

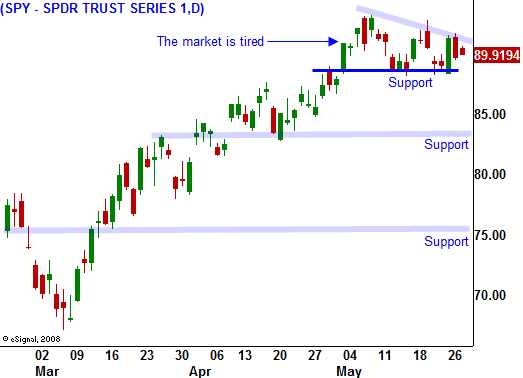

The unemployment rate continues to rise and continuing jobless claims reached 6.8 million this week. Initial jobless claims dropped slightly to 623,000 last week. The Unemployment Report will be released next Friday and it will influence trading. Bulls have been able to discount the number but they are running out of time. The market is tired and poor economic releases are once again having a negative impact on the market. Last month's Unemployment Report looked better than it was because the government hired 60,000 census workers. We won’t have that buffer to save us next week.

New home sales rose .3%, but median prices fell 15% year-over-year. One out of eight homeowners is late on loan payments or in foreclosure. Prime loans now make up the largest number of foreclosures and they have doubled in the last quarter. This means the credit crisis has spread from subprime to prime loans.

Banks are cutting lines of credit and they expect credit card defaults to rise above 22% before this cycle runs its course. That means consumers will not be able to return to their old spending habits, even if they want to. Furthermore, Congress passed the credit card bill last week and banks will be very tight with new loans.

Tuesday's rally was all "fluff". As the market rallied in light volume, sellers pulled their offers. The momentum was established early and shorts did not stand in the way. The first trading day of the week has been bullish recently. After the initial surge, the market stalls and it gradually drifts lower the rest of the week. That is the same price action we saw after India’s election rally last week. The market has run out of catalysts and the headwinds are blowing.

Major resistance lies at SPY 94 (200-day moving average, long-term downtrend, horizontal resistance) and the market has run out of gas. As I've been stating in recent weeks, interest rates will be the next concern. As the US and other countries issue debt, investors will demand higher rates of return.

Wednesday, the market staged a sharp reversal when 10-year bond yield rose dramatically. The Fed pledged to buy $300 billion in US treasuries (over a six month period). Just a few weeks into its “quantitative easing program”, they had spent one third of the money and interest rates continued to move higher. The treasury is just getting started and rates will move much higher regardless of the Fed’s actions. Once again, higher interest rates will constrain spending and it will keep a lid on growth.

Interest rates will continue to move higher and the market will not be able to penetrate major resistance. Consequently, I believe the next move is lower. I am selling out of the money call spreads and I am selectively buying puts on stocks that have relative weakness. Option implied volatilities have dropped and buying strategies have become viable. End of month fund buying will give investors one more chance to "sell in May and go away". Economic releases next week will push the market below SPY 88 and that will create additional selling pressure. I am short retail, utility and defense stocks.

Daily Bulletin Continues...