Very Quiet Trading Has Set In – Keep Your Size Small – Line Up Shorts!

Yesterday, the market made quite a run on light volume. Traders are still just getting back from an extended weekend. Once the upward momentum was established, sellers pulled their offers and traders got out of the way.

The first day of the trading week has been bullish recently and traders don't want to go home short heading into a weekend. They simply don't want to be blindsided by a new government bailout/plan. Once the initial move stalls, the market has tended to drift lower the remainder of the week.

Tuesday's catalyst was a much better than expected consumer confidence number. It jumped more than it has in six years. While the news was encouraging, it's important to keep it in perspective. Two months ago, people were burying gold in their backyards and buying guns to protect it. This may be an exaggeration, but it's not far from the truth. We were all terrified by the thought of a financial collapse. Those fears have subsided and of course confidence spiked. However, consumers will not return to their old spending habits when jobs are tight.

Existing home sales were up 2.9% in April and that was slightly better than expected. However, the inventory of new homes rose 8.8% and the median home price fell 15.4% year-over-year. On the luxury end of the spectrum, there is a 40-month inventory of homes priced over $750,000. Banks won't even consider a jumbo mortgage without a down payment of more than 30%.

The FDIC said that the number of troubled banks rose 40% quarter over quarter. Credit cards and mortgages are to blame and 305 banks could go under. This is the highest level since 1994.

Tomorrow, we will get durable goods orders and initial jobless claims. Last month, durable goods came in better than expected and that could provide a spark before the open. Initial jobless claims continue to rise and every week, the market shrugs off the number. Consequently, I don’t expect it to weigh down the market. On Friday, the GDP will be released. It came in much weaker than expected last month and it could be the spoiler bears are looking for.

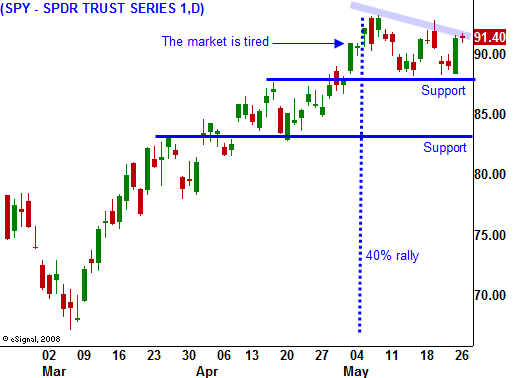

As you can see in today's chart, the upward momentum has stalled and the market is searching for a "driver". I don't believe it will find one. All of the good news has been factored in and now we will have to deal with rising interest rates. This should provide a stiff head wind and I do not believe the market will break through SPY 94 until it has a meaningful pullback.

Quiet trading has set in and the volume is very light. I have been selling out of the money call credit spreads to distance myself from the action. Retail, utility and defense stocks have been my favorite shorts. If the SPY breaks below 88, I will buy puts. For now, I am happy with my positions and I will not add in this lackluster environment. I am also short puts on commodity stocks from earlier in the month and those positions are doing very well. Keep your size small and wait for signs of weakness before you add to short positions.

Advancers equal decliners and this is shaping up to be the quietest day in months. The market has traded higher and lower and it lacks direction. I'm not expecting any big moves today and the early intraday range should hold.

Daily Bulletin Continues...