The Market Is Preparing For A Big Move – I Expect A Breakdown Late Next Week!

Yesterday, the market put in a lackluster day until early afternoon. The results of the $26 billion 7-year bond auction were released and relative to Wednesday's bond auction, the "bid" was slightly better than expected. This auction was oversubscribed by a multiple of 2.6 and that is decent, but not great. Clearly, traders were tuned in to the results and when they were in line, they bought stocks.

Interest rates are creeping higher as the treasury issues a mountain of debt to pay for stimulus and bailout programs. To no avail, the Fed has tried to intervene by purchasing treasuries. They have spent $200 billion of their $300 billion budget and it has not kept interest rates in check. When the Fed buys treasuries it puts downward pressure on the US dollar. That is why we've seen commodity prices lift off. The next big auctions will take place in two weeks and I believe they will have a negative impact on the market.

This morning, consumer confidence improved to its highest level in eight months as gauged by the University of Michigan's survey. This reaffirms Tuesday's consumer confidence number. This psychological improvement is important to our economy since 70% of GDP comes from consumption. However, with the unemployment rate rising, I doubt that consumers will recklessly resume their prior spending habits.

This morning, GDP was revised to -5.7% from -6.1% last month. That is an improvement; however analysts were looking for a bigger revision. Business investment dropped 36.9% in the first quarter and residential investment plunged 38.7%. This is not good news for the construction industry and builders will continue to struggle. Consistent with consumer sentiment, spending on durable goods rose 9.6%. People are feeling better about the economy and they are gradually opening up their wallets. However, it's important to remember that spending was almost nonexistent a few months ago and this increase still leaves us far below normal levels.

The Chicago Purchasing Managers Index dropped to 34.9 when analysts expected a reading of 42. Manufacturing in the Midwest is very weak and somehow this number has been swept under the carpet.

The news today was not particularly bullish, but the market is trying to stage a rally. Traders do not want to short the market heading into the weekend. The government can pull another rabbit out of their hat and bears do not want to get blindsided. The first trading day of the week has been positive during the last month. Monday's impetus could come from China's PMI. This release will help traders gage the success of China's stimulus plan.

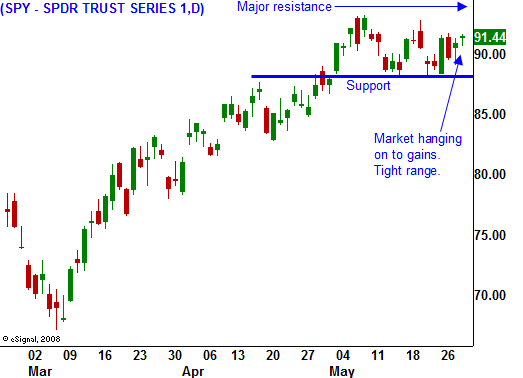

End of month fund buying has helped the market and it continues to tread water. We've fallen into a narrow trading range and one way or the other, a breakout is coming. Rising interest rates will keep a lid on this market and I still believe the next big move is lower. Bears need to convincingly push the market below SPY 88 to get the ball rolling.

ISM manufacturing, personal income, the ADP employment index, factory orders, ISM services, initial jobless claims and the unemployment report will be released next week. The market has been able to shrug off weak economic data, but I sense that bulls are getting tired and bad news will once again have a negative impact. I suspect that the market will weaken late next week and it will decline after the bond auction results in two weeks.

The market is quiet today and is trading in a narrow range. Since we could see a Monday morning rally, I would not want to initiate new short positions today. By the middle of next week, I will be selling out of the money call credit spreads on retail, utility and defense stocks. These positions are performing well and I will look to add to them. I also shorted put credit spreads and commodity stocks earlier in the month and those positions are safely out of harm’s way. I feel these stocks are ahead of themselves after a huge rally and I will not add to positions unless I see a meaningful pullback.

Daily Bulletin Continues...