Next Week Is Filled With Economic Releases and Events. Here’s What To Watch!

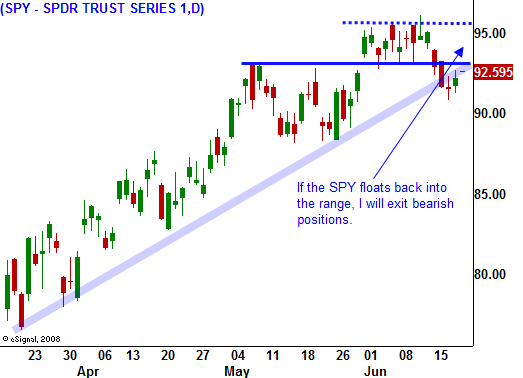

This week, the bears were able to flex their muscles and they pushed the market below support at SPY 93. It looked like they might be able to generate selling momentum and all they needed was a late day selloff yesterday. That didn’t happen and the market showed its resilience as buyers gradually stepped up.

Before Thursday’s open, continuing jobless claims dropped by 148,000. Later in the morning, LEI and the Philly Fed came in better than expected. The S&P 500 popped five points on the news. These improvements sparked buying and the market gradually added to its gains throughout the day.

This morning, the S&P 500 futures are up eight points before the open and it looks like we will have a positive day. If the market is able to close above SPY 93, we will drift right back in to a very tight trading range. The bears will have squandered an excellent opportunity and traders will wait for new information.

There isn't any major news to drive the market today. RIMM posted better-than-expected earnings, but it lowered its forecast. The stock is flat and it won't provide any impetus to the tech sector. Next week is filled with many economic releases and events.

On the economic front, existing home sales, durable goods orders, new home sales, initial jobless claims, Q1 GDP, personal income and Michigan sentiment will be released. Of these numbers, durable goods orders and home sales are likely to have the biggest impact. Last month, durable goods orders surprised to the upside by a large margin and if that trend continues it will produce a rally. Analysts have been expecting improvement in new and existing home sales. With the recent 1% jump in mortgage rates, I am not expecting a major upside surprise. This will be the final GDP number for the first quarter and after months of revisions; it should not provide any surprises either. Overall, I would give the economic releases a slightly bullish bias, especially if continuing jobless claims drop for a second straight week.

Other events of importance include the FOMC meeting, a record bond auction and end-of-quarter "window dressing". The FOMC is likely to be accommodative and they want to contain interest rates. The market will view that as positive. The obstacle will be reality. Yesterday, the Treasury announced that it will sell $104 billion worth of three-year, five year and seven-year notes next week (Tuesday, Wednesday, and Thursday). This is a record bond auction and it will put upward pressure on yields. The Treasury needs to fund a massive $1.8 trillion deficit this year and they need to aggressively sell bonds. Towards the end of the week, Asset Managers will be buying stock. They don't want to appear as if they missed this rally and they will be "window dressing" if they are under-allocated. It is hard to say which of these events will have the biggest impact. The FOMC and window dressing are definite positives. However, weak bond auctions could spoil everything and they will carry the most weight. If the auctions go poorly, the market will drop. If the bond auctions go well, we could see a rally that challenges SPY 96.

Our government is financing our largest debt level ever with short-term maturities. This means that it has a great amount of exposure to a rise in long-term interest rates. As the spending increases, interest rates will continue higher and the government will have to roll their debt at a high cost. I don't believe they are able to issue a large amount of long-term debt without spiking those rates. More than half of our debt will have to be financed outside of the US. Countries do not know how our recovery will play out and they do not want to make long-term commitments.

I have been bearish and I continue to be bearish. Bear market rallies can last much longer than expected and they lure traders into believing that they are the "real deal".

Bulls are pinning their hopes on government stimulus/bailouts, growth in China and a rebound in consumption. Extraordinary debt cannot be solved with more debt and ultimately, taxpayers will pay for the government's actions. As for China, one country (other than the US) cannot pull the world out of a recession. It is stockpiling commodities because it wants to diversify away from its US dollar holdings. They are not using all of the commodities for manufacturing and construction as most people believe. More than one third of their economy depends on exports and global weakness will result in a buildup of inventories. US consumers make up 70% of GDP and they are tapped out. Higher taxes, lower property values (no access to home-equity loans), unemployment, high personal debt levels, small retirement accounts, tight credit and rising gasoline costs will keep consumption in check.

I don't know when the market will roll over. Trends are tough to reverse and the three-month rally from March has been very strong. I only know that I will be ready to take short positions when it happens. Until then, I will wait patiently and I will not take aggressive bullish positions.

If the market floats back into its tight trading range I will sell put spreads on strong stocks and I will still call spreads on weak stocks. The longer this trading range exists, the bigger the breakout/breakdown. Consequently, I will be keeping my size small. We could slip into "summer doldrums" as the market looks for direction. Those light volume situations can be very boring. I hope that this does not unfold, but it is a distinct possibility.

For today, expect choppy quadruple-witching action. The early rally will run its course in the first two hours of trading and then things should settle down. If we close above SPY 93, I will be exiting my bearish positions at a loss. The drop I was looking for did not materialize and it's time to admit that I was wrong. If by chance we get a big late day decline (not likely) I will stick with my short positions through the weekend.

Daily Bulletin Continues...