We Have a Breakdown – Start Buying Puts!

Last week, the market staged a very gradual decline. Just when it looked like major support would be broken, buyers passively stepped in. They were able to keep the market from falling during quadruple witching. Rising interest rates are the concern and yields on the 30-year bond have climbed 1% in the last month.

This week, the Treasury will auction a record $104 billion in 3-year, 5-year and 7-year notes. Our government has to finance a $1.8 trillion budget deficit and these auctions will continue far into the future. Every other week, bulls will be dodging bullets in hopes that the auctions go well and interest rates stay low.

The Fed committed to purchasing over $800 billion in mortgages, but its plan has not kept a lid on lending rates. It also blew through the $300 billion "quantitative easing fund" where it purchased treasuries (printed money). Short-term rates continued to skyrocket and it is obvious that the government can't keep interest rates from moving higher.

Wednesday, we will hear from the FOMC. They are likely to continue with a very loose monetary policy and the market is expecting them to be accommodated. The problem is that the Fed is no longer in control of interest rates. The huge glut of treasuries coming to market will push interest rates higher regardless of the Fed's policy. Investors demand higher returns as the supply of new bonds continues to hit the market. More than half of the money needed will be raised from foreign investors.

Existing home sales, durable goods orders, initialed jobless claims, GDP and personal income will impact the market this week, but they will play a minor role relative to interest rate related events. I would give the economic news a slight positive bias since jobless claims shown signs of a bottom in recent weeks and durable goods orders exceeded expectations last month. This is the final revision for Q1 GDP and the changes should be minor.

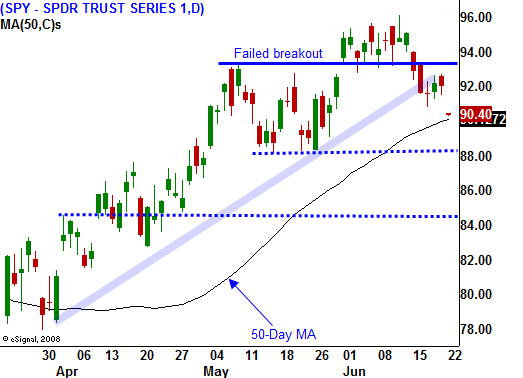

The market has broken support at SPY 93 and the breakout two weeks ago failed. This is important because many traders rushed in to buy the breakout. Now that the market is rolling over, they will bail out of losing positions. We could see a swift decline. Profit-taking will also set in after a big 40% rally during the last three months.

Today's action is very weak and decliners outnumber advancers by 7 to 1. There is a crack in the dam and you can start buying puts and weak stocks. Defense, restaurants, retailers and REITS are my favorite shorts. Use SPY 93 as your stop on a closing basis. As the stocks move lower, manage your profits and trail your stops. I believe we could drop down to SPY 84 before we see decent support.

Daily Bulletin Continues...