Lots of News Over the Next 3 Days. Keep Size Small Ahead of the Holiday!

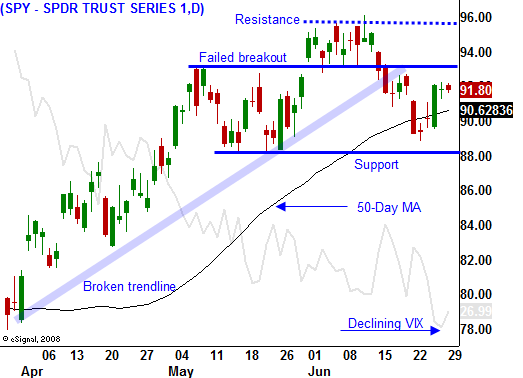

Last week, the market staged a nice selloff and it broke below support. The upside breakout above SPY 93 appeared to be a head fake and the market was rolling over. The selling continued Tuesday ahead of the FOMC.

The Fed maintained its interest-rate policy, but it said that it would not purchase US Treasuries after the September deadline. It also stated that inflation is not a concern at this juncture. The market had a slightly negative reaction after the release. Traders felt that if the Fed stops buying treasuries, yields might rise faster than they have.

Bulls will be dodging this bullet every other week since the Treasury has to issue debt to finance its $2 trillion budget deficit this year. Interest rates have been on the rise and each auction will be scrutinized. Last week's record auctions ($104 billion) went well. That gave the market a bullish piece of news to rally from.

Thursday, end of quarter "window dressing" and rebalancing in the Russell 2000 sparked a massive rally. This buying could push us right back into the tight trading range we saw a two weeks ago.

This is a holiday shortened trading week with many economic releases. Trading will be light and moves could be exaggerated. Consumer confidence, the Case-Schiller home price index, Chicago PMI, ADP employment index, construction spending, ISM manufacturing, pending home sales, auto sales, initial jobless claims, factory orders and the Unemployment Report will all be released in a 3-day period. Consumer confidence rose much more than expected last month and it could have a positive influence tomorrow.

End of month fund buying and window dressing could still have a positive influence today and tomorrow. Asset Managers that are under allocated will try to catch up. The market is staging a nice rally this morning and advancers outnumber decliners by 3:2. Once again, the bears have squandered a great opportunity. The market is just below SPY 93 and I get the impression it won't take much to rally it back through that resistance level.

The market is searching for a driver and it has fallen into the summer doldrums. There isn't any material news to generate a sustained move and the market is just chopping back and forth on individual news items. We can expect to see that same type of price action for the next two weeks.

Initial jobless claims have been weaker than expected and I believe the Unemployment Report will disappoint. That does not mean the market will tank. It has been able to rally the last few months as the jobless rate increases.

Earnings season starts in two weeks and it will spark the next move. Over 70% of the companies in the S&P 500 beat expectations last quarter. The market has rallied 40% off of the March lows and decent results are expected in Q2. The guidance for Q3 will set the tone for the market the rest of the summer.

From a trading standpoint, I am starting to close bearish positions today. We did not see any follow through to the downside and I can't risk getting caught in a light volume rally ahead of the holiday. I plan to stay on the sidelines this week unless the market can break below SPY 89. Neither side has the upper hand and I don't want to get chopped up by short-term moves.

Daily Bulletin Continues...