Two Steps Forward – Two Steps Backwards. Keep Your Size Small!

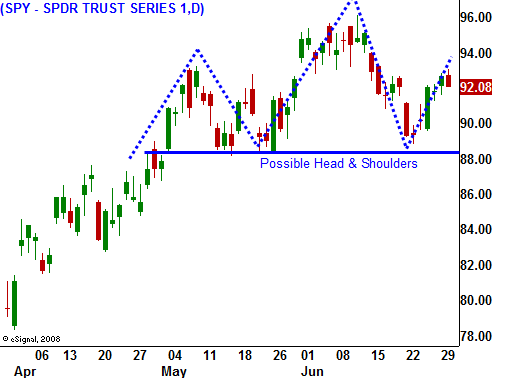

Yesterday, the market posted another solid day of gains. End of month buying and Q2 window dressing pushed the market right up to resistance at SPY 93.

The move we have seen in the last three trading days has been very "artificial". Portfolio managers are buying stocks so that they don't appear to have missed the recent rally. They are also adjusting for index rebalancing. There hasn't been much news to drive the market.

Last week, the Fed said that they will maintain their current interest rate policy. They will not be buying Treasuries past their September deadline and that could cause yields to rise faster than they have. The record $104 billion bond auction went well last week and interest rates pulled back slightly.

Today, consumer confidence came in lighter than expected. Jobs are hard to find and that has reduced discretionary spending. People are holding off on purchases until they see signs of improvement. The Case-Schiller index showed that home prices dropped .6% in April and that was a large improvement from the 2.2% drop in March.

The economic news tomorrow will drive the market. The ADP employment index will give us a peek into Thursday's Unemployment Report. Analysts are looking for a loss of 363,000 jobs compared to a loss of 532,000 jobs last month. If the number does not show improvement, it will create selling pressure. ISM manufacturing will also be released. Last month it rose to 42.8 and analysts expect it to rise again to 44.

Thursday, initial jobless claims, factory orders and the Unemployment Report will be released. Bulls continued to discount the unemployment number saying that it is a lagging piece of information. However, the jobless rate continues to exceed their expectations. Our economy can't rebound if people are unemployed. As I stated earlier, people that have jobs are not confident and they are cutting consumption because they fear a layoff.

Earnings season is a week away and decent results are expected. Stocks have rallied 40% off of their low and more than two thirds of the companies exceeded earnings expectations last quarter. The guidance for Q3 will determine where the market goes the rest of this summer. I expect the most action during the first two weeks of earnings and then the action will settle down.

The market seems comfortable at this level and choppy, low-volume trading has set in while we wait for new information.

Today, the market is taking back some of the "fluff" we saw during the last three trading days. It is still below SPY 93 and that is bearish. Nervousness has set in ahead of the Unemployment Report. Decliners outnumber advancers by 2 to 1 and we are likely to see a down day. I closed most of my short positions yesterday and I am hanging on to the remainder. If the SPY closes above 93, I will sell the rest of my puts. This is a dangerous market to trade since it takes two steps forward and two steps back. It will chop you up if you take large positions. Keep your size small and wait for a bona fide breakout or breakdown.

Daily Bulletin Continues...