Window Dressing and Russell 2000 Rebalancing Sparked A Big Rally – Bears Need A Decline Today!

Yesterday morning, the market briefly tested the downside after initial jobless claims came in worse than expected. After a one-week reprieve, continuing claims also rose. Within the first 30 minutes, those losses were erased in the market staged a massive rally.

End of quarter window dressing and rebalancing in the Russell 2000 sparked buying. Funds need to purchase stocks three days early to account for settlement (T+3). While I suspected a rally, I did not think it would be nearly that large. On the close, buy balances pushed the S&P futures 10 points higher in the last few minutes of trading. I feel that this rally was artificial and we could see weakness today.

Traders will still be adjusting their positions and we can expect some volatility today. As the Unemployment Report approaches next week, nervous trading should set in. Traders have been waiting for signs of an employment recovery and month after month the jobless rate keeps climbing. In recent weeks, initial jobless claims and continuing claims have not supported that theory. The economic news will be compressed next week due to the Fourth of July holiday.

Consumer confidence, the Case-Schiller home price index, Chicago PMI, ADP employment index, construction spending, ISM manufacturing, factory orders, initial jobless claims and the Unemployment Report will all be released Tuesday, Wednesday and Thursday.

After next week, earnings season will begin. Almost 70% of the companies beat earnings expectations in Q1 and decent results for Q2 are priced in after a 40% rally from the March lows. The market has been directionless and earnings should push it in one direction or the other.

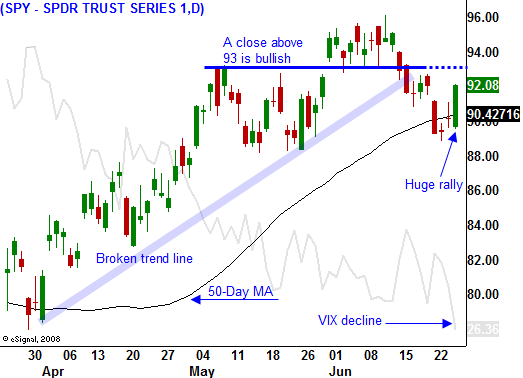

Trading has been very choppy. Prior to yesterday's rally, bears had the upper hand. The market has drifted lower over the last two weeks and technical support was broken on Monday. I have been bearish and unfortunately, the selling pressure was not great enough to push the market lower. If bulls can add to yesterday's gains and close above SPY 93, they will have regained momentum and the market could challenge the highs from two weeks ago.

The convincing breakdown earlier in the week is now suspect. This week's record $104 billion bond auction went well and that is also supporting this rally. Bulls will be dodging the interest rate bullet every other week as the Treasury continues to issue new debt. The Fed wants to stay accommodative, but they will not be purchasing Treasuries after September. This means rates could rise quicker than they have this summer.

I still feel that the next move is lower, but I don't want to get blindsided by a light-volume holiday rally. I have just started building my put position. By scaling in, I have the advantage of re-evaluating. If the market closes above SPY 93 today I will sell my puts and take my losses. Monday's have been relatively weak the last 3 weeks and ideally I will carry short positions over the weekend.

Traders will still be squaring positions today and anything can happen. Advancers and decliners are equal and the market could go either way today.

If the market declines and erases most of yesterday's gains, it will set up for a negative open on Monday. Keep your size small in this choppy market and favor the downside as long as the SPY stays below 93.

Daily Bulletin Continues...