Yesterday’s Strong Reversal Paves The Way Higher – A New Relative High!

In the last five months, the market has staged a 45% rally. Over 11% of that rally has come in the last three weeks and the market is not showing any signs of weakness. If it were going to pull back, yesterday was the perfect opportunity. Durable goods orders were weaker than expected, the afternoon bond auction went poorly and yields rose and China (the driver behind this economic recovery) had a 5% market decline overnight. Stocks were lower most of the day and then they rebounded.

Bulls are convinced that a recovery is underway. This morning, initial jobless claims rose by 25,000 (more than expected) and while that should have been bearish, the market liked the number. Continuing claims fell by 54,000 and they now stand at 6.2 million. While that is significant, part of this improvement could be due to expiring claims that were extended by the government. Regardless, the market is viewing the data is positive and the S&P futures are up 10 points in pre-open trading. A peak in jobless claims would suggest that a peak in the unemployment rate is only three months away.

Bulls have been able to discount the present and I question their faith in the future. Cyclical stocks (like steel and heavy equipment) have been posting poor results and providing dismal guidance. Transportation stocks (railroads and truckers) have reported low volume and they are not seeing signs of improvement. Energy production has been cut and oil inventories continue to grow. Before the global recovery can take root, we will see the price of oil stage a sustained rally. It is essential to every economy and the demand will increase. All of these early signs are missing.

From an earnings standpoint, corporations have easily exceeded lowball estimates. In Q1, 70% of the companies "beat" and that percentage might be even higher in Q2. Businesses have reacted quickly and they have slashed expenses. The bottom line has been preserved, but top line growth is flat at best. The next stage of the rally will rely heavily on revenue growth (demand).

Consumption accounts for 70% of our GDP. Rising unemployment, falling home prices, high personal debt levels, underfunded retirement accounts and the threat of higher taxes will keep people from spending money. Businesses will be slow to hire employees. This week Caterpillar said that they can increase production without having to hire people back. Businesses want to make sure that conditions are improving and they want to see how the new health care plan will impact their costs. Home prices might have stabilized, but they are not rebounding to any large degree. There is a huge inventory of homes and any uptick in demand will be offset by rising foreclosure rates. Banks are still reluctant to finance homes over $300,000. For more than two decades, the personal savings rate has declined and it even went negative for two years before the financial crisis struck. Six months of a high savings rate is wonderful, but it doesn't make up for the last 20 years. The average baby boomer has less than $60,000 saved for retirement. Corporations are cutting costs and in many cases they have stopped matching 401(k) contributions. The government, states, and municipalities are running in the red. Politicians don't know how to cut costs and the only way for them to balance their budget is to increase taxes. In short, Americans are getting hit from every angle and I don't believe they will return to their reckless spending habits.

The whole world is counting on China to pull us out of this mess. That in and of itself is a scary thought since China will do what's best for China. Over 30% of their GDP comes from exports. If the world isn’t buying, they run the risk of overproducing.

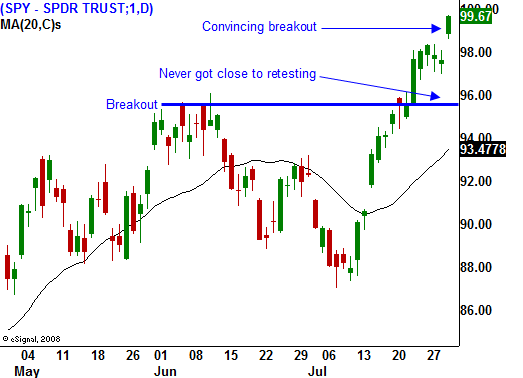

As someone who is skeptical of this rally, I hope it goes to the moon. I will embrace it and I will trade it very cautiously. When it runs its course, the reversal will be fast and furious. I would prefer this scenario since it gives us plenty of action. The alternative is a market that settles into a tight trading range and chops around while it waits for new information. If the market can't add to these gains, it is likely to fall back into the range.

We have heard from every group and sector and I don't believe earnings will be a huge catalyst from this point on. Next week is loaded with economic releases. Construction spending, ISM manufacturing, auto sales, personal income, pending home sales, ADP employment index, factory orders, ISM services, initial claims and the Unemployment Report will be released. The market has been able to discount weak economic news to this point and given my scenarios, I hope that continues.

Bears have been seriously wounded and the greatest risk lies to the upside. After such a huge run-up, no one wants to short this market.

I will sell out of the money put credit spreads to distance myself from the action. That will allow me to make money and I will have time to adjust my positions if the market rally fails.

Today, the market has a full head of steam and after yesterday's reversal; I expect a strong showing. Advancers outnumber decliners by a 7 to 1 margin in the first 30 minutes of trading. Sell of the money puts on strong stocks that have released good earnings and keep your size small.

Daily Bulletin Continues...