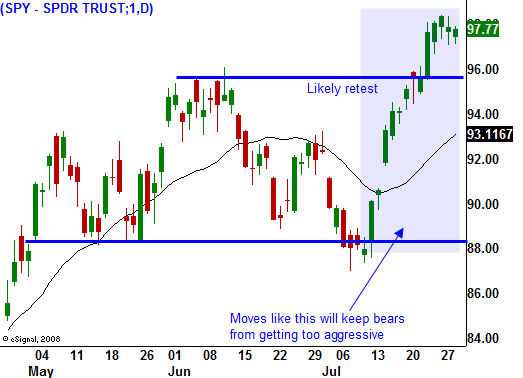

5% Drop In Chinese Stocks Has Investors Spooked – Watch For A Test Of The SPY 96 Level!

The market has staged a huge rally and it is looking for its next catalyst. Profits have easily beaten estimates and decent results are expected as we enter the home stretch for earnings season.

My concern with this rally is that transportation stocks and energy stocks are moving higher on weak fundamentals. Railroads and truckers reported weak results and at best, they do not see a recovery until the middle of next year. Oil exploration and production has been cut, yet oil supplies are building. If a global economic recovery were underway, demand would be depleting this inventory and prices would be rising. Until these two conditions change, I can't embrace a long-term rally.

The unemployment rate continues to rise and companies will not hire until they see conditions improving. Many employers won't hire until they see just how health care reform will impact their bottom line. This is a huge expense and they don't want to get blindsided by policy changes.

China is one of the only countries with spending power. The other industrialized nations of the world have enormous debt levels. One country can't pull the rest of the world out of a recession.

Capacity utilization is low and until that improves, capital expenditures will be low. Consumption is the key to this problem and spending drives 70% of our GDP. Unfortunately, Americans have shifted from "shop till you drop" to "save to the grave".

The average baby boomer has less than $60,000 saved for retirement. Corporations are cutting expenses and many have stopped matching 401(k) contributions. This will only make it harder to save for retirement. Many of us realize that we will never see Social Security. People are also worried that they might lose their jobs and they are not spending. The government, states and municipalities are running in the red and we can all expect to pay higher taxes across-the-board. In short, consumers are getting squeezed from all sides.

Once the threat of a financial collapse subsided, a massive relief rally ensued. The market is up 40% from its March low and it might still have another 10% left. Earnings have been good, but they have been the result of cost controls. Revenue growth has been minimal and it will be the key to any rally above this level.

I am short term bullish and long-term bearish. On a short-term basis, negative economic news (like the durable goods number today) can actually be a positive for bulls. They have been able to discount all of the economic data as "old news". They point to decreasing rates of change and they are happy with results that are "less bad". Interest rates move lower on weak economic news and that preserves the rally. All of the bets are that the numbers will turn. If they fail to, this pattern will reverse quickly and bad news will once again be bad news.

This afternoon, the Fed will release the Beige Book. It is likely to move the market. Tomorrow, initial jobless claims and second quarter GDP will be released. The Fourth of July holiday and seasonal adjustments have exaggerated the employment scene and jobless claims have the potential to disappoint the market. Q1 GDP came in much lower than expected and the same could happen in Q2. Analysts are expecting a decline of 1.5%.

The market has made a fantastic run and it has broken through resistance at SPY 96. I expect that level to be tested. If it holds, the market could gradually grind higher. My gut tells me that the breakout will fail and we will float back into the trading range. Late comers will get shaken out on this pullback and the market will screw as many traders as possible.

I am favoring a "buy the dip" approach. The market has staged massive rallies and the greatest risk lies on the upside. As a result, I am writing put credit spreads. The market is overdue for a pullback. As it comes in, be patient and start scaling into short put positions on strong stocks.

The market has been able to rebound from every decline in the last three weeks. Today could be different. The downside was tested early and it reversed quickly. That rally fizzled and two hours into trading, prices are gradually drifting lower. Decliners outnumber advancers by 2 to 1. If we make a new daily low after two o'clock Eastern, we could see selling into the closing bell. Healthcare has been catching a bid. Obama's health care reform initiative is not going well and the stocks have lagged the market. They are worth considering for put writing. Keep your size small.

Daily Bulletin Continues...