Bears Will Not Stand In The Way Of This Freight Train – Look For Quiet/Choppy Trading

It is customary for me to take a week off in August and today I want to focus on what I believe the market will do over the course of the next week. First of all, earning season is winding down. The remaining releases should not have a major impact on the market. The biggest economic release each month is the Unemployment Report and we got that news this morning. In short, the market will trade off of economic releases and a series of light volume reactions is likely next week.

This morning, the Unemployment Report came in much better than expected. On average, analysts were looking for the decline of 320,000 jobs. During the month of July, only 247,000 jobs were lost. The unemployment rate improved to 9.4% from 9.5% in June. Another encouraging sign is that June's number was revised to show that 43,000 fewer jobs were lost than previously reported. Average hourly earnings also improved slightly. The market has staged an impressive rally and it is making a new relative high.

Bulls have argued that conditions are improving and that the economic numbers have been slow to reflect that. Today’s unemployment number certainly confirms that notion. Across the board, economic activity has declined at a slower rate and conditions are "less bad". Next week, productivity, wholesale inventories, trade balance, the FOMC meeting, initial claims, retail sales, CPI, industrial production and consumer sentiment will be released. The FOMC is likely to keep its rhetoric the same, but if they hint of higher rates (20% chance), the market will react negatively. The CPI has been benign and I don't believe it will spike higher or cause negative reaction. Retail sales could be a market negative. Many companies have posted July's sales results and more than half missed estimates. The market already has this news and it could be priced in. Regardless, bulls have been able to discount this news in the past and they are likely to do so again next week. They will argue that improving employment conditions will stimulate future consumption.

As the market moves higher, rising interest rates will provide a headwind. To date, interest rates have remained relatively low and the Treasury has been able to successfully hold record bond auctions. They have focused on short-term maturities but next Wednesday and Thursday there will be a 10-year note auction and a 30-year bond auction. The appetite for long-term maturities has not been great and I suspect that interest rates could creep higher. While this might provide a headwind for the market, rising interest rates in an improving economy are not bearish.

I don't see bears standing in the way of this freight train during light volume conditions. They have already been declawed and they will let this rally run its course. Asset Managers who are under allocated will be looking for buying opportunities and they may not get the dip they were hoping for.

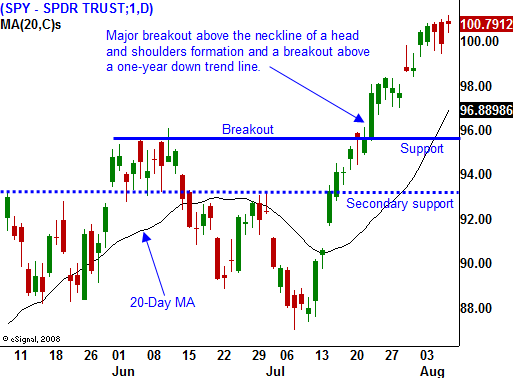

The market has tested the 200-day moving average and it held. It has also broken the downtrend line that dates back one year. On a long-term chart, you can see that an inverted head and shoulders pattern has formed and we have broken out to the upside. These are all bullish technical indicators.

The market has made a huge run in a very short amount of time and it is overbought. All of the issues that caused us to decline still linger and that will come back to haunt us in the future. Consequently, I prefer to use a conservative bullish approach. I suggest you sell out of the money put credit spreads on strong stocks that have released earnings. Implied volatilities are still relatively high on a historic basis and that bodes well for this strategy. Make sure there is a support level between the short strike price and the current price of the stock. As long as the SPY is able to hold the 96 support level, maintain your positions.

Keep your size small and look for a choppy market that has a slightly bullish bias. When I resumed my analysis a week from now I will have a fresh perspective and we will be ready for a busy fall season.

Good luck with your trades.

Daily Bulletin Continues...