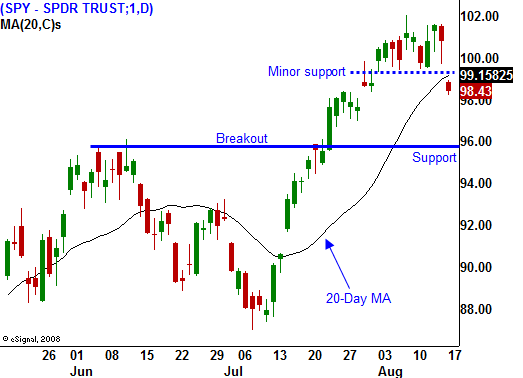

Pullback Long Overdue – Look For SPY 96 To Be Tested!

After a week off, the market has welcomed me back with a cold splash of water. The S&P 500 futures are down 20 points in pre-open trading. Let's start with a review of the key events from last week.

The Unemployment Report came in much better than expected two weeks ago and that should have provided solid support for trading last week. The FOMC is keeping interest rates down and they said they would expand the timeline for quantitative easing. It was slated to end in September and that should have been a positive for the market. Thursday, retail sales came in weaker than expected. Two weeks ago, retailers released July's sales results and weakness should have been expected. Initial jobless claims came in as expected and continuing claims dropped by 150,000. Long-term claims could be falling for two reasons. Either people are finding jobs or their unemployment benefits have run out. This improvement is likely to error on the bullish side. The CPI came in flat and inflation is not a concern.

Friday, the market digested the week's news and it tested the downside. The decline was substantial and the S&P 500 was down 20 points throughout the day. The market rebounded by the close and buyers stepped in.

Asian markets took a pounding overnight and the Shanghai Index was down more than 5%. The Chinese market has been leading the recovery and it is down 17% in 3 weeks. Europe followed suit and those markets are down 2.5%. This morning, Lowe's posted lower-than-expected profits and their guidance was weak. Capital One announced that loan defaults (credit cards, autos) are increasing and so are delinquencies. The Empire Manufacturing Index came in much better than expected, but the headwinds are too strong for it to have much of an impact.

The economic news this week will be rather light. PPI, housing starts, initial claims, LEI and Philly Fed will be released. I don't see any of these having a major market impact.

On the earnings front, Home Depot, Target, T.J. Maxx, Hewlett-Packard, BJ's Wholesale, John Deere, Game Stop, Sears Holding, Aeropostale, and Nordstrom's will release results. Retailers will dominate the action and there is room for disappointment.

Option expiration is likely to have a bullish influence since the market is at the high end of its trading range. However, after a steep decline this morning, I doubt that traders will risk legging out of hedged positions in an effort to make some extra coin. As a result, option expiration might not have any impact on the market this month.

This pullback is long overdue and I expect the SPY breakout above 96 to be tested. There wasn't any negative news to justify this move and it looks like profit-taking. Bulls still hold the upper hand and selling out of the money put spreads is the best strategy. Pullbacks like this are the reason I have favored this approach. As long as the breakout holds, I will maintain my positions. If the market rolls over, I will start buying back some of my short put positions. Given that we are days away from expiration, most of my risk will disappear this week and I will be able to reevaluate.

Shorting this market has been a losing proposition and it is still too early to call a top. I would not aggressively sell out of the money call spreads yet.

Today, the market will probe the downside and I expect it to bounce off of those lows by late afternoon. Retail earnings could weigh on the market this week, but much of that news is already priced in. Look for choppy trading and keep your size small.

Daily Bulletin Continues...