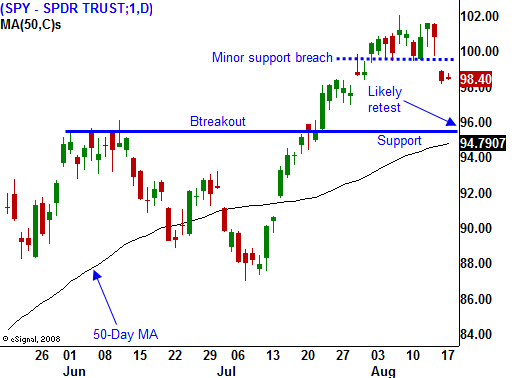

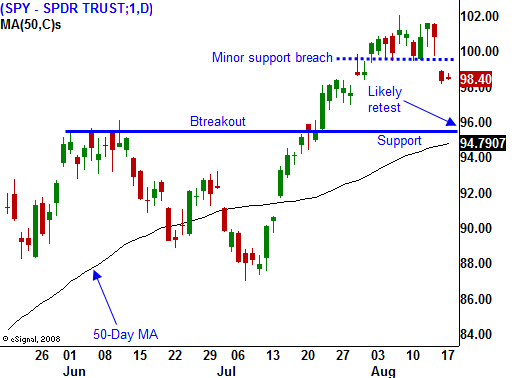

SPY 96 Likely To Be Tested – Support Should Hold This Week!

Yesterday, the market sold off after a 5% decline in the Chinese stock market. That selling spilled over to Asian and European markets and the S&P 500 gapped below minor technical support levels. Buyers took a break and we did not see a rally into the close.

Weak results from Lowe's added to the selling pressure and Capital One reported that loan defaults and delinquencies were on the rise. A better than expected Empire Manufacturing Index did little to boost morale.

This morning, Target and Home Depot announced better-than-expected results. The PPI decreased by .9% and housing starts fell 1%. From my perspective, low inflation is positive. If you strip out multi-family starts, single-family home starts rose 1.7% and that is a fairly bullish number. All in all the news was rather good and the market is trying to rebound.

As we head into the end of summer, trading activity will drop off considerably. The market will chop back and forth on light volume while it bides time. Interest rates are low and Q2 earnings came in much better than expected. This provides a solid backdrop for bulls to lean on. Traders will be looking for top line growth heading into year end, but there is plenty of time for that to materialize.

The Chinese market has been the catalyst for much of this rally. It is down 17% during the last three weeks and profit-taking has set in after a huge run-up. Our market has not run up as much, but it is vulnerable to profit taking as well. Shorts have been annihilated and they are not going to stick their neck out until they see major technical support levels fail. Although I am long-term bearish, I do not see yesterday's decline as anything more than profit-taking. On a short-term basis, this market has a bit more upside before it runs into trouble.

The economic releases are rather light this week and I expect the focus to be on earnings. Hewlett-Packard releases results after the close and that could have an impact on tech stocks. The shares are priced for good news and I believe they will deliver. Even though this company tends to beat estimates, it might not rally after the news. Retailers will dominate the releases the rest of the week. Estimates are low and most retailers should be able to beat expectations. Revenues have been weak and that could be an issue in Q3 particularly if back-to-school sales are low.

I am maintaining my short put positions and every day that passes makes it easier to manage them. We are only a few days away from option expiration and I believe the SPY 96 support level could get tested, but it will hold. Selling out of the money put spreads on strong stocks that have released good earnings still makes the most sense. Distance yourself from the action and keep your size small. As long as SPY 96 holds, maintain this strategy.

Trading should be relatively quiet today.

Daily Bulletin Continues...