A 20% Drop In Chinese Stocks Spreads Fear – Global Stocks Are Rebounding From Early Loses!

Yesterday, the market rebounded after a nasty decline on Monday. Weak results from Lowe's and comments from Capital One started the week off on a negative note. Tuesday, Home Depot and Target beat earnings estimates and the market erased some of the prior day's losses.

The Chinese market has been a focal point and it has declined 20% in the last two weeks. It weighed on our market Monday when it fell 5% and it is weighing on our market today after an overnight 4% drop. The Shanghai Index has rallied 80% in the last seven months compared to 45% for our market. China has the money to fund its stimulus program and investors piled in. I see this pullback as a warning shot, but I believe their market will stabilize now that some of the froth has been taken out.

The US stock market is up about half as much and it is not as vulnerable to a major pullback. After an initial decline this morning, stocks have stabilized. You can tell that volume is light and that traders are searching for a catalyst when comments from Warren Buffett can tumble a market. I would not read too much into any market move that takes place during the next three weeks.

Normal trading volumes will return in September. Low interest rates and better than expected earnings will allow bulls to maintain their upper hand. As the year progresses, comps will get easier to beat and we are likely to see substantial earnings growth rates. Costs have been cut and any uptick in demand will go straight to the bottom line.

Economic releases are light this week and tomorrow we will get initial jobless claims and LEI. Both numbers are expected to be relatively unchanged and I don't believe we will see a big market reaction from either.

This afternoon and tomorrow morning we will get earnings results from many retailers. The central theme has been better than expected profits on flat revenues. In the last week, the retail sector has pulled back about 4% and the market has priced in these results.

Hopes have been pinned on China to pull us out of this economic crisis. When their market pulls back it sends shockwaves around the globe. I do not believe that one country can pull the entire world out of a recession. However, China still has cash and firepower to keep the ball rolling through year-end.

Bears have had their heads handed to them and they will not aggressively short this market. Economic data is "less bad", interest rates have been moving lower and corporations have been profitable after cutting expenses. September is usually a seasonally weak period and once we get through it I believe we will see the final leg of this rally.

After Q4, reality will start to sink in. Corporations will be slow to rehire and unemployment will continue to be an issue. Consumers will be tight with their money and they will try to pay down their debt and save for retirement. Tax rates on a federal, state and local basis will rise and that will weigh on discretionary spending.

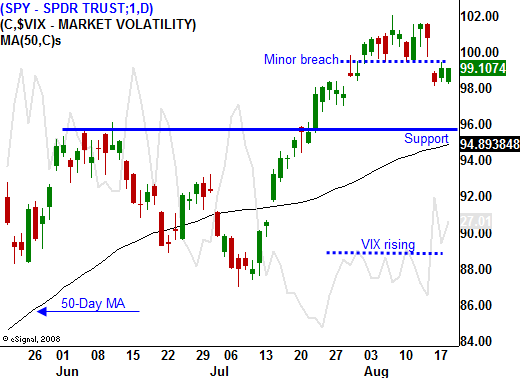

I still believe the best strategy is to sell out of the money put spreads on strong stocks that have produced good earnings and are strong relative to the market. As long as SPY 96 holds, I will continue to use this approach. Given that this is a seasonally weak period, extra caution must be used.

For today, US and European markets are rebounding from early declines. The A/D is a negative 1:2 and that is nothing like the 1:9 ratio we saw Monday. There is a bid to the market and I believe there is a chance for us to go positive today. If tomorrow's economic numbers come in as expected, this will be a mere bump in the road.

Daily Bulletin Continues...