Light Volume Profit Taking Sets In – Watch Support At SPY 101

A week ago, the market recovered from a nasty decline and as the week progressed it surged to a new high for the year. That rally resulted from decent economic news; short covering and option expiration buy programs.

This week, the market feels heavy and it has fallen into a tight range. While traders wait for the next "driver", the volume has fallen off. Yesterday, durable goods orders came in much better than expected. That improvement was largely due to commercial aircraft orders. Next month, cash for clunkers should provide a big pop to durable goods orders. New home sales were much better than expected and that provided a spark yesterday.

This morning, Q2 GDP was unchanged (-1%). Analysts forecasted it to drop from -1% to -1.5% and the number was better than expected. There are signs that conditions are stabilizing and GDP made a big jump from Q1 to Q2 (-5.4% versus -1%). Initial jobless claims were slightly higher than expected and 570,000 jobs were lost. However, continuing claims dropped by more than 110,000 and that is a positive.

Earnings season has ended and 70% of the companies beat expectations. Expenses have been cut and any improvement in revenues will go right to the bottom line. Interest rates are low and the Fed is committed to keeping them that way. Inflation is not a concern and economic releases are "less bad". These factors will keep a bid to the market and the path of least resistance is up.

Congress is not in session and economic releases will provide all of the action next week. Chicago PMI, ISM manufacturing, construction spending, auto sales, ADP employment index, factory orders, FOMC minutes, initial claims, ISM services, and the Unemployment Report will be released. Almost all of these numbers showed improvement last month and I expect the same next week. ISM services is one of the most important numbers since that sector accounts for 80% of our economic activity. Last month, the unemployment rate improved from 9.5% to 9.4%. This is the most important number of the month. If people don't have jobs, they won't spend money and the recession will linger. Initial jobless claims have not been particularly strong in the last three weeks and this release has me a little nervous.

September is the weakest month of the year and many people are looking for a pullback. Many people are also planning to buy that dip. I suspect that any decline will be met by demand and the selloff won't be that severe. Bears that attempt to short this seasonal pattern are likely to get the door slammed in their face - again. Asset Managers who are under allocated will want to place money before the year-end rally begins.

I am bullish through year-end and I will "buy the dips". The higher this market goes, the better the shorting opportunity next year. I believe the economy will be slow to recover and we are likely to see a major pullback next year.

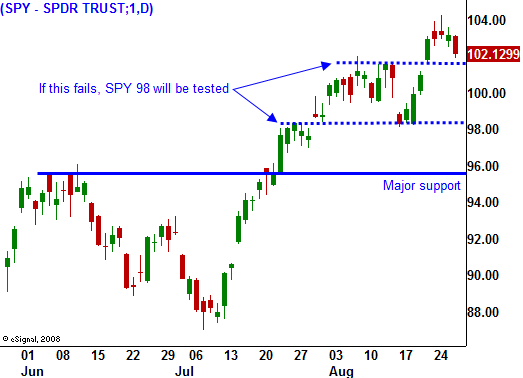

Because I am long-term bearish I can't aggressively engage this rally. I am selling out of the money put credit spreads on strong stocks. I have a fraction of my desired risk exposure on at this time and I will only add on market pullbacks. As long as SPY 96 holds, I will use this approach.

For today, the market wants to drift lower. When it failed to rally on the reappointment of Ben Bernanke this week, I knew profit-taking might set in. I want to see how well the breakout holds at SPY 101. Once the market finds support, be bullish, distance yourself from the action and keep your size small. Great trading is just around the corner and you want to keep your powder dry.

Daily Bulletin Continues...