The Path of Least Resistance Is Up. No News Is Good News!

Yesterday, the market continued its rally from last Friday. The Unemployment Report came in better than expected and buyers nibbled on the news. Sellers are not going to step in front of this freight train after being run over the last few months.

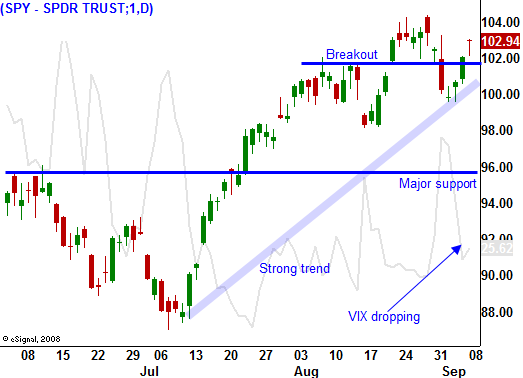

This is a very light news week and the path of least resistance is up. Technicians can point to a strong uptrend since March with multiple breakouts to new relative highs. Fundamental investors take comfort in low interest rates, solid earnings and improving economic numbers.

September is traditionally the weakest month out of the year and many analysts are calling for a pullback. From my perspective, that could be wishful thinking since many Asset Managers are under-allocated. They are hoping for a pullback so that they can place money. This market has not conformed to traditional patterns and I doubt that we will see much of a decline.

Bond auctions have gone well and interest rates remain low. The Fed is committed to "easy money" and they have not provided a timeline for an exit strategy (implying it is some time away). Earnings have beaten expectations by a large margin and Q3 comparatives should be easy to top since the recession started over a year ago.

This afternoon the Fed will release its Beige Book. I expect to see economic improvement on a region to region basis and the report should be construed as "less bad". Traders are likely to have a positive reaction. I am not looking for a major rally, just a small grind higher.

Tomorrow, initial claims will be released. That is the only other newsworthy item this week. This could be a negative for the market since we have not seen much improvement in the last three weeks. Traders could start getting anxious if they don't see a rebound in jobs.

The market has rallied back above the breakout and the dip last week was very brief. That tells me that bulls are still in control. I am selling put credit spreads this week and when I am finished, I will still only have 50% of my target risk exposure. For the rest of the month, I will only add on weakness after the market finds support.

Focus on strong stocks that released good earnings and held up well last week. The market is waiting for new information and this strategy allows you to take advantage of time decay.

For today, I expect to see marginal gains and a close near the high of the day. Tomorrow, I expect to see today's gains taken back after a lack of improvement in initial claims. Stay bullish, keep your distance and trade smaller size.

Daily Bulletin Continues...