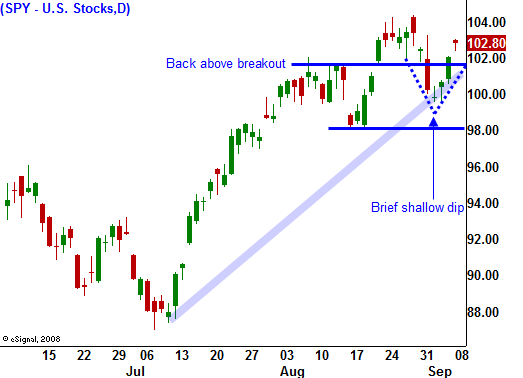

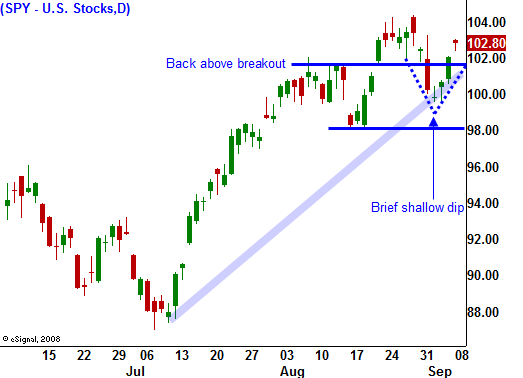

A Solid Unemployment Number Rallies The Market Back Above the Breakout!

Friday, the long-awaited Unemployment Report was released. The Labor Department reported that employers cut 216,000 jobs, the smallest in over a year. Economists had expected 225,000 job losses in the number T-man better-than-expected. The unemployment statistics for June and July collectively improved by 49,000 jobs and that is a positive. We are still losing jobs albeit at a slower rate and the unemployment rate hit 9.7% (a 26 year high).

The number was good and the market reaction positive. Trading activity was very light and no one was going to short this market heading into a long weekend. As the day wore on the market continued to grind higher.

This morning, positive price action overseas set a bullish backdrop for our market and we opened higher. Kraft is making a bid for Cadbury. Mergers and acquisitions are starting to heat up a little and that is positive for the market. Last week Disney announced its intentions to take over Marvel and EBay found a buyer for Skype.

The economic releases have been decent. Durable goods orders, GDP, ISM manufacturing, ISM services and the Unemployment Report have all exceeded expectations. The Fed is committed to keeping interest rates low and Ben Bernanke will remain at the helm. Bond auctions have gone well and interest rates remain low. I don't see any reason for a market decline and seasonality alone (September is the weakest month) won't be enough to spook investors.

Earnings will have easy comps from last year and we should see nice profit growth in Q3. Intel raised guidance last week and that should bode well for semi conductors and tech in general.

The economic releases are minimal this week and the market is likely to be very quiet. I am maintaining my bullish bias and I am adding new put credit spreads since conditions have stabilized. Focus on stocks that have good earnings and held up during last week's market decline. Distance yourself from the action and take advantage of time decay.

After the initial rally, the market has settled down. I'm not expecting much action this afternoon.

Daily Bulletin Continues...