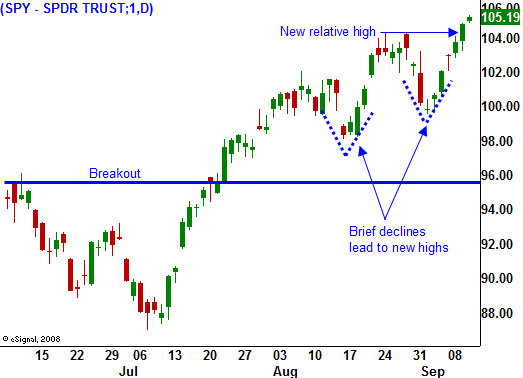

A New Relative High On 9/11 – Look For The Rally To Continue!

n today's chart you can see the strength of this rally. During the last two months, we have had two very brief declines. In both cases, buyers quickly stepped in and the market rebounded. Those dips also led to a new relative high.

Today, the market is continuing to push higher. Consumer confidence rose to 70.2, up from 65.7 in August. Spending accounts for 70% of our GDP and this is an important improvement.

Almost all of the economic statistics have rebounded from their lows in recent months. Here are a list of economic indicators that have exceeded expectations recently, durable goods orders, GDP, ISM services, ISM manufacturing, and unemployment. Traders are comfortable with the concept of "less bad" and they want to see continual improvement.

Interest rates are low and they are likely to stay that way through year-end. The bond auctions went very well this week and even the 30-year bond had strong demand. This means that the government is able to finance our debt longer-term. It was a relatively small percentage of the overall auction so I would not get too excited about this. However, the shorter-term maturities have seen a very strong bid to cover. The Fed has also stated that it wants to maintain its current interest-rate policy. Ben Bernanke will remain at the helm and fixed income markets will remain orderly.

Earnings beat expectations by a large margin last quarter. The comparatives for Q3 will be easy to beat since the recession started over a year ago. Last week, Intel raised guidance and that has sparked a rally in semiconductor stocks. Today, FedEx said that it sees signs of economic improvement. This transportation stock is often considered a barometer for economic activity.

As I outlined in yesterday's commentary, there are a number of economic releases next week. Inflation is contained and the CPI and PPI are not likely to have a negative impact. Retail stocks have been rallying to new highs and there is room for disappointment when retail sales are released. However, no one wants to short these stocks heading into the holiday season. If housing starts come in stronger than expected, that could spark a rally later in the week. All told, the numbers should be consistent with the "less bad" theme and they should provide a positive backdrop for the market.

The market is making a new relative high and option expiration is likely to have a positive influence. As the market creeps higher, traders who are short calls will have to start reeling them in. If the rally is orderly, option traders will leg out of hedged positions and that will "goose" the market. We might also see a small round of short covering. This should be minor since most shorts have already taken their lumps.

When I hear everyone reference seasonal weakness in September, it makes me skeptical. As I have been writing, I feel there are many under allocated Asset Managers who need to play catch up. They are aggressively buying every dip and they can't afford to be left out of this rally.

Transportation and energy stocks are catching a bid and that is a healthy sign for this rally. Stay long and focus on stocks that have released solid earnings and are leading the market higher. I expect a decent rally next week, but I am not looking for an explosive move higher. This rally has been orderly and the easy money has been made. Take profits along the way and buy the dips.

We should see a quiet grind higher today.

Let us remember those who died on 9/11 and let us thank those who keep us safe.

Daily Bulletin Continues...