Early Weakness And A Quick Rebound Point Higher This Week!

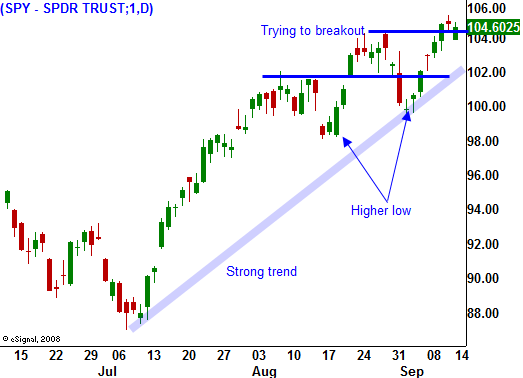

Last week, the market rallied right up to the high of the year on light volume. Traders are still trying to get back into the groove after the holiday and they are searching for any piece of news that might drive activity.

This morning, the market started off on a weak note. The US threatened to impose tariffs on Chinese tires and that action did not go unchallenged. China said it would launch an anti-dumping investigation into imports of US vehicles and chickens. The idea of a full-blown trade war with the fastest growing economy of the world splashed cold water on the market this morning. After an early decline, prices have rebounded and traders believe this will be resolved before it goes any further.

I must sound like a broken record. There has not been any new information and the path of least resistance is up.

Economic releases this week are not likely to pack any punch. Inflation has been contained and the CPI and PPI are not likely to generate much excitement. Retail sales will be released tomorrow and they have been dragging. The RTH is near a high for the year and there is room for disappointment. However, this sector should hold up fairly well heading into the holiday season. Empire Manufacturing, industrial production and the Philly Fed should show marginal improvement. Housing starts could provide a small spark if the number materially beats expectations. Interest rates are low and this cycle is so deep that we are likely to see some signs of a bottom soon. Initial claims have not moved the market much in recent weeks. All told, the "less bad" theme should remain intact and prices should creep higher.

Most bears have covered and I do not believe we will see a big short squeeze if the market makes new highs. Asset Managers who are under allocated will continue to nibble at this level as they try to catch up. Option expiration should have a positive influence and traders will be looking for any signs of upward momentum. If they get it, they will leg out of hedged positions on an intraday basis and that will "goose" the market.

The news has been good and there's no reason to believe that a major decline lies right around the corner. Interest rates are low, earnings have greatly exceeded expectations, third-quarter comparatives should be easy to beat and economic conditions continue to gradually improve.

Advancers and decliners are equal and the market is likely to chop around today. Energy stocks have started to move higher on a weak dollar and I like selling out of the money puts in this sector. I have almost 50% of my desired risk exposure at this time and I don't plan on adding unless I see a pullback. I am short out of the money puts on strong stocks and I want to keep my distance. Normal activity levels should return in two weeks. Be patient.

Daily Bulletin Continues...