FOMC Is Not Likely To Hint Of Exit Strategy – Look For A Small Rally.

The market is in "wait and see mode" ahead of the FOMC's announcement. This is a relatively light news week and traders are looking for any information that might drive the market.

Last week, Chairman Bernanke said that the recession has unofficially ended. He tempered any excitement by saying that growth would be anemic. The economy is just starting to recover and I doubt the Fed will hint of an exit strategy for quantitative easing. They had to pull out all of stops to avoid a full blown financial collapse and they won't impede this recovery until they are convinced that it is self-sustaining. This means interest rates will stay low and the dollar will remain weak. The market would have a positive reaction to a status quo policy.

Mortgage applications rose 12.8% last week and the four-week moving average is up almost 5%. Low interest rates, falling home prices and an $8000 first time home buyer tax credit are fueling demand. Tomorrow we will get existing home sales and Friday we will get new home sales figures. I believe both could surprise to the upside and they might spark a rally. This housing decline has been dramatic and we should see a bottom soon.

Initial jobless claims have been increasing at a slower pace and I expect that trend to continue. This number should not have much of an influence on the market tomorrow. Durable goods orders will also be released and cash for clunkers should create a temporary spike. Traders will view the number as a one-time event and it won't generate a reaction unless there are improvements in non-transportation orders.

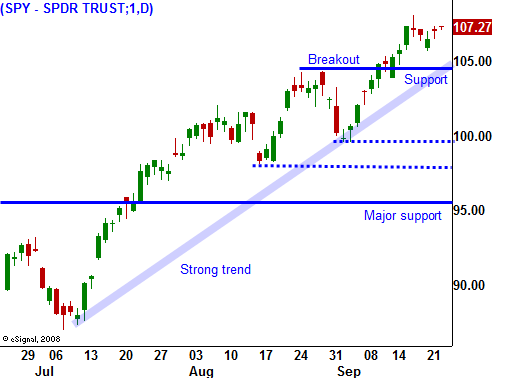

The market feels tired after a big run last week and we are vulnerable to a sharp decline. This would keep the bulls honest and some of the optimism would be flushed out of the market. I expect SPY 100 to hold.

Next week we will have many economic releases including the Unemployment Report. There could be nervousness ahead of the number and we could test SPY 100. Asset Managers that have missed this move will aggressively buy stocks heading into year end and that is why I do not believe we will see a big decline.

Be patient and "buy the dips". If you have been buying calls, stick with those positions as long as the SPY is above 105. If we break below that level you should stop yourself out. You should also be prepared to take profits if the market rallies after the FOMC.

I have been selling out of the money puts for the last few months and I'm happy with the returns on this strategy. The two declines that we've seen did not even get close to my stop levels and I was able to calmly evaluate the market. We are in the seventh inning of this rally and I am starting to see some stock valuations that are rich. As a result, I still like selling out of the money puts in this environment.

Trading will be quiet ahead of the FOMC. If my scenario plays out, stocks should move higher after the announcement. I am not looking for an explosive move, just a grind higher. Resistance at SPY 110 should hold into the Unemployment Report. Normal activity levels should return after next week as Q3 earnings season approaches.

Daily Bulletin Continues...