The Fed Is Not Likely To Change Its Rhetoric – That Should Support The Market.

After a very busy week that included a big market rally, traders are taking a breather. This is a fairly light news week and volumes are light.

All eyes are on the FOMC meeting tomorrow and traders will look for any hint of tightening. The Fed will stop buying treasuries at the end of the month and this might put upward pressure on short term yields. I believe the Fed wants to see how this change will play out before they start disclosing an exit strategy. Economic conditions are gradually improving, but the recovery is very fragile. I believe they stay the course and keep their rhetoric the same. That should have a positive influence on the market.

Low interest rates are good for businesses and consumers. Banks have a huge spread between the borrowing and lending rate and they are making great money in this environment. They will distance themselves from the financial crisis with very quarter that passes. As banks offset their losses, they will eventually start to ease lending practices. The Fed does not want to spoil this process.

If interest rates start moving higher, the dollar will rally. Over the last two months, we have seen that the market favors a weak dollar.

Initial jobless claims, durable goods orders, consumer sentiment, existing home sales and new home sales will be released Thursday and Friday. The news should have a positive impact on the market, but these releases don't typically generate a sustained move. The bigger economic releases will come next week and I believe we could see quiet trading after the FOMC's announcement.

This is the calm before the storm and trading activity will pick up shortly. In addition to the Unemployment Report and other economic releases, we are likely to see end of month fund buying next week. In two weeks, Q3 earnings season will be upon us. September is typically the weakest month of the year and as it passes, Asset Managers that are under-allocated will start getting very nervous. They have been waiting for a pullback and they haven't gotten one. This means they will invest aggressively. They can't afford to miss a year-end rally and they have to catch up to their benchmarks.

Earnings should be good in Q3 and I expect to see growth. This recession is more than a year old and last year's comps will be easy to beat. A "friendly" interest-rate environment and solid earnings will fuel a year-end rally. Prices have already rebounded and I'm not looking for a massive spike. I believe we will see a steady climb higher and sectors that have underperformed will show the biggest gains.

After dramatic gains, the chance for a sharp but brief decline is high. That is why I prefer to sell out of the money put spreads. Focus on stocks that will not release earnings until after October expiration. This will keep you a safe distance from the action and it will minimize "earnings surprises".

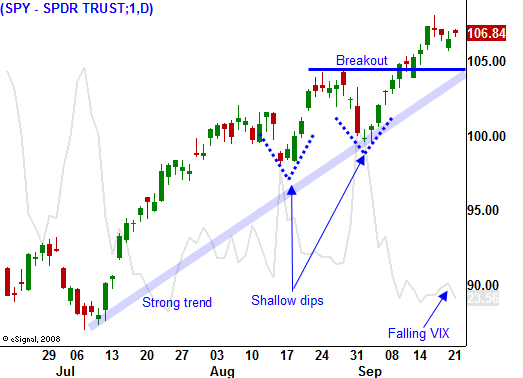

Look for quiet trading ahead of tomorrow's announcement. Activity will settle down after the initial reaction and traders will start looking ahead to next week. Stay bullish as long as the SPY is above 105 and be patient. The best bullish trades will come on pullbacks.

Daily Bulletin Continues...