Expect Nervous Trading Ahead Of The Unemployment Report – Wait For Support Then Buy!

Wednesday, the Fed gave the market what it wanted. They are committed to keeping interest rates low and that is good for businesses and consumers. The market had a positive reaction after their statement, but it was not able to push higher. In the last hour of trading, profit-taking set in and the market staged a key reversal. Many technicians watch this price action carefully since it often signifies a top.

Yesterday, initial jobless claims came in better than expected. That sparked a brief rally on the open, but sellers quickly pushed the market lower. Existing home sales were weaker than expected after a big jump in July's number. That added to the weakness and the market spent most of the day in negative territory. Near the close, it was able to recover some of the losses.

This morning, durable goods orders fell by 2.4% when an increase of .5% was expected. The drop was mainly due to a 42% decline in nondefense aircraft orders. Excluding transportation, durable goods orders were flat. The market did not have much of a reaction to the number. After the open, new home sales figures were released. They increased by .7% in that was slightly below expectations. Michigan consumer sentiment rose to 73.5, its highest level in over 18 months. This was much better than expected. All told, the economic releases did not have much of an impact and the market and it is flat 90 minutes after the open.

From a fundamental standpoint, major news is on the horizon. Next week, we will get an onslaught of economic releases, culminating with the Unemployment Report on Friday. I expect some nervous trading throughout the week, but end of month fund buying should keep selling pressure in check. After next week, earnings season will be upon us and normal trading activity levels will return.

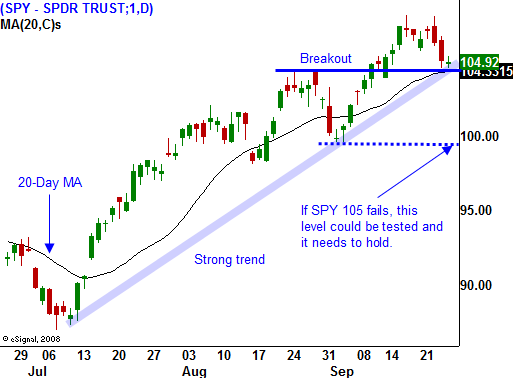

From a technical standpoint, SPY 105 represents the recent breakout and we should find support at this level. If it fails, we are likely to drift lower next week. However, I expect SPY 100 to hold. If we break below that support it will signify strong overhead resistance and the recent highs are likely to stay in place for at least a month.

The more likely scenario is that we drift lower next week and find support before SPY 100 is tested. This dip will set up a buying opportunity heading into earnings season. Revenues will appear to improve in Q3 due to favorable comps from a year ago and profits will grow. This will instill confidence and the market will rally. The last two pullbacks were brief and they lead to new relative highs. If this plays out, we will establish another “higher low”.

Asset Managers can't afford to miss this rally and they will keep a bid to the market. Don't expect a huge run-up. The market has already rallied 60% from its low and the easy money has been made. We are likely to see a series of rallies and pullbacks as the market moves higher. In this two steps forward, one step backwards environment, it is important to buy the dips and to set targets as the market rallies. I am selling out of the money put spreads. This strategy allows me to keep my distance from the action and I'm not as dependent on timing my entry and exit.

The market is very quiet today and I expect a tight range heading into the weekend. With all of the news due out next week, traders are not likely to take big positions. If the market closes below SPY 105, be patient and wait for support. If it is able to hold this level, this might be the extent of the pullback.

Daily Bulletin Continues...