Merger Monday Provides A Boost – Expect Choppy Trading – Stay Bullish!

Interest rates and earnings drive the market. Yields continue to drop and last quarter’s profits were much better than expected.

Last week, the Fed stated that they would remain accommodative. Low interest rates are good for corporations and consumers. After the news was released, the market rallied a bit and then staged a key reversal. Stocks closed on their low of the day Wednesday and that set up technical selling on Thursday and early Friday. By Friday’s close, the market found a bid.

Earnings season will start up in two weeks. This recession is more than a year old and that means easy year-over-year comps. We are likely to see earnings and revenue growth. Corporations have been quick to cut expenses and any uptick in sales will go right to the bottom line.

These two key components should translate into a year-end rally. Since the market has rallied 60% off its lows, I am not expecting a rally that simply forges ahead. The easy money has been made and we are likely to see "two steps forward and one step backwards". This means we need to "buy the dips and sell the rips". Selling out of the money put credit spreads on strong stocks is an alternative strategy that requires less timing. Distance yourself from the action and let time take care of the rest.

The economic news has been "less bad" and I expect that to continue. Last week, durable goods orders and existing home sales came in weaker than expected, but both posted huge gains in July. This leads me to believe that the prior month may have been overstated. The economic calendar is very full this week and the releases include consumer confidence, the ADP employment index, GDP, Chicago PMI, personal income, initial jobless claims, construction spending, ISM manufacturing, auto sales, factory orders and the Unemployment Report. Jobs are obviously the most important release this week.

We could see nervousness ahead of Friday's number. Analysts expect to see a loss of 180,000 jobs in September and the unemployment rate is expected to climb to 9.8%. If we get anything better than last month's -216,000, I think the market will rally. Traders simply want to see month-over-month improvement. If the number comes in worse than expected, I believe the market will be able to shoulder the news after a brief decline.

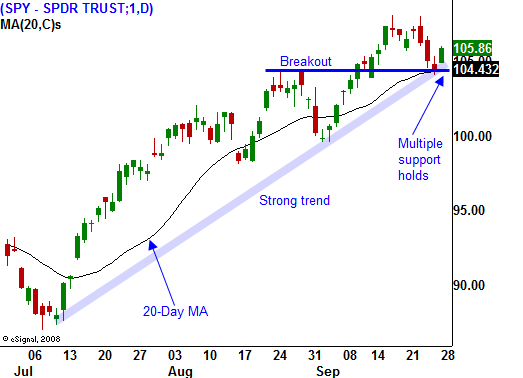

As long as SPY 100 holds, I feel confident selling out of the money put spreads. The pullback we saw last week was very brief, just like the prior two declines. Each dip has established a higher low and the market has rallied to a higher high. Asset Managers are aggressively supporting this market because they don't want to miss a year-end rally.

M&A is creeping back into the market and we've seen a number of deals in the last few weeks. There were a couple announcements today and "Merger Monday" has provided a boost to this morning's action. Advancers outnumber decliners by 6 to 1 and the market should be able to hold gains today. We are back above SPY 105 and that is bullish.

Expect some volatility this week and don't read too much into these choppy moves. As long as the SPY stays above 100, stay bullish. Normal trading volume will return in two weeks during earnings season.

Daily Bulletin Continues...