Earnings Season Kicks Off Today. This Will be The Catalyst For A Rally!

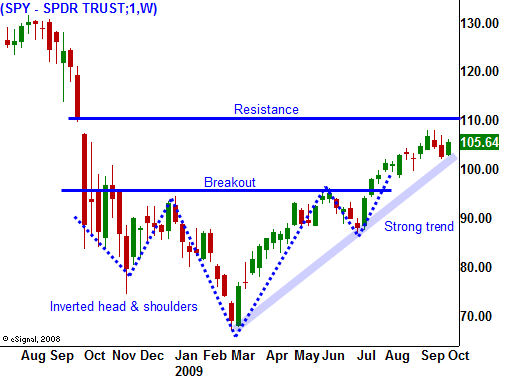

Yesterday, the market staged a nice rebound and the SPY finished back above 105. We are now within striking distance of the high and earnings season will kick off this afternoon.

The economic news is fairly light this week, but it started off on a good note. ISM services rose to 50.9, indicating economic expansion. The service sector accounts for 80% of our economic activity and this was an important number. With the exception of the Unemployment Report last week, the economic numbers have been pretty decent. Tomorrow, initial jobless claims and retail sales will be released. The market is bracing itself for dismal results in both cases and there is a slight chance for a positive reaction to the news.

Without question, the market is waiting for earnings to be released and that catalyst will fuel the next move. I believe it will be to the upside. This time last year, we were well into the recession and companies should be able to beat last year's results. That means we could actually see some revenue growth. Earnings will be strong since companies have dramatically reduced expenses.

The first round of earnings will come from the financial sector and major tech stocks. Banks will be making money hand over fist. The spread between the borrowing and lending rate has never been better. Write-downs should also subside as banks sit on toxic assets. Tech stocks have led this rally and the major companies should post excellent results.

Interest rates remain low and that is good for consumers and businesses. From an investment standpoint, people want higher returns and equities (not fixed income) offer that opportunity.

Asset Managers are playing catch up and they don't want to miss a year and rally. That is why the last few dips have been very brief and shallow.

Earnings releases next week could start a gradual rally. If that takes root, option expiration could fuel the market back up to the old highs.

I expect quiet trading this week with a bullish bias. I am selling out of the money put spreads on strong stocks that release earnings after option expiration. Next week, I will start selling put options on companies that have posted solid numbers.

Daily Bulletin Continues...