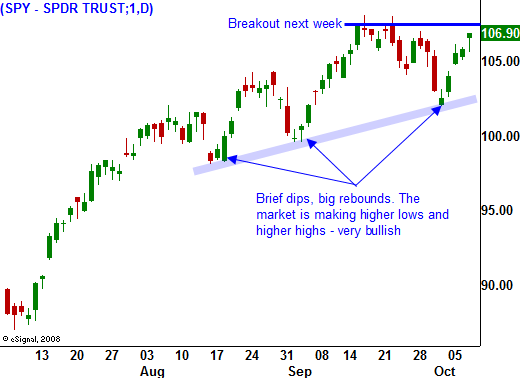

The Market Is Close To A New High – Play The Breakout!

The market continues to move higher and we are one good day away from establishing a new high for the year. As I mentioned yesterday, retail sales and initial jobless claims had the potential to rally the market.

Most retailers posted better-than-expected same-store sales. A late Labor Day holiday delayed back-to-school purchases and that showed up in this month's figure.

Initial jobless claims are very volatile week-to-week and that is why most analysts follow the four-week moving average. Last week's number was so far from estimates that I felt we might get a knee-jerk reaction the other way. That's exactly what happened and initial claims dropped 33,000. Analysts had expected new claims to come in at 540,000 and only 521,000 were reported. The four-week moving average fell 9,000 to 540,000. Continuing claims are also very important and they fell by a whopping 72,000. That number stands just above 6 million, the lowest level since late March.

Wholesale inventories fell by 1.3% in August. That is the 12th consecutive monthly drop. Sales posted their largest gain in more than a year. They rose 1% in August, following a .6% drop in July. This means inventories will need to be replenished, prompting Goldman Sachs to project that the GDP will grow at an annual rate of 3% during the July - September quarter.

These are all positive signs and as I have been mentioning, economic data has been "less bad". I don't see that changing during the next few months. There are a handful of important releases next week, but they will take a backseat to earnings.

Interest rates are low and the Fed is committed to keeping them that way. As banks rake in huge profits, they will offset their toxic assets and build back their balance sheets. Eventually, lending practices will ease and consumers and businesses will have access to much-needed financing.

Earnings season officially kicked off yesterday and the market has responded positively to all of the releases. Banks and large-cap tech will dominate the scene during the next two weeks. The major announcements next week include Johnson & Johnson, CSX, Intel, J.P. Morgan Chase, Charles Schwab, Citigroup, Goldman Sachs, Google, IBM, Bank of America and General Electric. In total, I am expecting very good results and these releases should push the market to a new high.

The S&P 500 is near its high of the year and a nudge higher is likely to spark option expiration buy programs. We have made it through the weakest part of the year from the seasonality standpoint and that bodes well for a year-end rally.

I can't stress this point enough. The easy money has been made and you need to "buy the dips and sell the rips". That means you are continually taking profits and going to cash. When the market pulls back, you are scaling into new long positions. This approach allows you to continually reevaluate the market. A great opportunity lies ahead in the next week – don’t miss it.

Daily Bulletin Continues...