A Great GDP Number Is Barely Enough To Spark A Rally. Jobs Will Be An Issue Next Week!

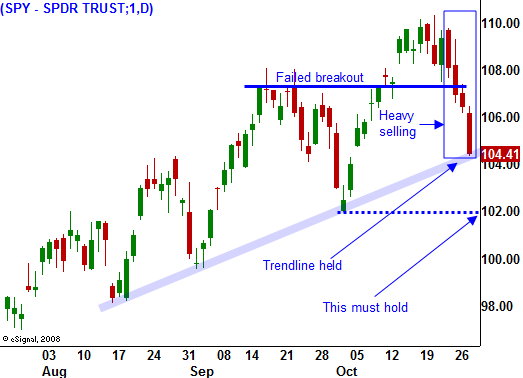

This week, the market is showing some signs of strain. Four consecutive days of heavy profit-taking pushed the market down to the uptrend line that dates back three months.

Earnings have been decent, but that is already priced into the market. After beating expectations, stocks have been trading lower after the release. This is an indication that the market is "fully valued". The majority of companies have posted results and since we have heard from most groups, the surprise element is starting to wane.

On the bullish side of the ledger, low interest rates, solid earnings growth and "less bad" economic numbers will support the market. We are in a bullish seasonal timeframe and Wall Street would love to have the market close right here so that year-end bonus checks can get cut. Under these conditions, I don't believe we will see a major decline in the next two months. However, the headwinds are starting to blow.

Today, the government has stopped its purchase of US Treasuries. As global interest rates move higher, money will flow into those assets. That will make our bond auctions less attractive and the demand will fall. Implied interest rates will rise as bond prices decline. The Fed will feel greater pressure to raise rates as 2010 approaches. This morning, GDP rose 3.5% and that was much better than expected. As economic conditions improve, the need for "easy money" subsides.

I am always trying to forecast future economic activity and two leading indicators have me concerned. Transportation stocks have not been able to lead this rally and the guidance has been very cautious. Inventories have been depleted and shipping activity should be increasing as they are replenished. That is not the case. Secondly, oil is the fabric to every major economy in the world, yet oil inventories are high. Production and exploration have been curbed and demand is soft. If global activity is increasing, oil consumption should be moving higher. Prices have moved higher because the supply has been reduced, not because a greater quantity of oil is being consumed.

Next week, economic releases will once again be at the forefront. Construction spending, ISM manufacturing, pending home sales, the ADP employment index, ISM services and the Unemployment Report will be released. I expect nervous trading ahead of Friday's release. Last month, the unemployment picture was much worse than expected. Initial jobless claims have not improved significantly during the last four weeks and traders will get nervous. They want don't see steady improvement and that has been slow to materialize. Today, initial jobless claims only dropped 1000 from last week. The four-week moving average had been dropping steadily, but it is starting to flatten out. This is not a good sign since jobs are the cornerstone to a recovery.

Next week, we will also hear from the FOMC. I am not expecting any new rhetoric and they will continue to support low interest rates. This should be mildly bullish for the market, but it will not be enough to offset profit taking.

The price action is getting heavy, but that does not mean we will see a big decline. The last dip was more severe and it lasted longer than the prior two declines. The subsequent breakout to new highs was also smaller in magnitude. During the last week, the selling pressure has been more sustained. This means that we are in the late stages of this rally.

As long as SPY 102 holds, I believe we will see a trading range for the rest of the year.

Don't try to pick a top. I suggest selling put credit spreads on tech and retail stocks and selling call credit spreads on cyclical stocks. Your put credit spreads should out number your call credit spreads by about 2 to 1. Review earnings announcements and pay particular attention to the guidance before you establish positions.

For today, the rally has stalled and I believe we will maintain this level. If prices start to slip this afternoon, that would be bearish, particularly if we close below yesterday's low.

Daily Bulletin Continues...