Nervous Trading Will Test Support Next Week – I Expect It To Hold. I’m Lining Up Longs.

Volatility has returned and prices have been all over the board this week. Earnings have been very good and so have the economic numbers.

Almost 80% of the companies are beating third-quarter estimates. Unfortunately, great results are priced in and many stocks are trading lower after a good number. We are through the meat of earnings season and the surprise element will diminish next week.

Durable goods orders were right in line Wednesday and GDP posted a huge 3.5% gain yesterday. Goldman Sachs had lowered its estimate down to 2.7% on Wednesday and that generated selling pressure. When the actual number beat estimates, a major rally ensued. Initial jobless claims were lost in the shuffle. They only decreased by 1000 and that is not enough of an improvement to sustain optimism. Fears of a jobless recovery are starting to surface. The four-week moving average for initial jobless claims is starting to flatten out. The results during the last month have not shown much improvement and that is causing nervousness ahead of next week's Unemployment Report.

Traders are content with the current numbers. Interest rates are low, earnings are good and economic numbers have been improving. However, it is the future that weighs on their minds.

Yesterday, the seven year bond auction did not go well. Interest rates will start creeping higher now that other countries are raising their rates. The Fed abandoned its quantitative easing program yesterday and it will no longer buy treasuries. Next week, the FOMC will release its statement and I'm expecting it to be "dovish". Unfortunately, their desire to keep interest rates low won't matter if global rates are moving higher. Bond auctions will not fare well and the implied interest rate will start to rise.

Earnings have been good, but top line growth has been hard to come by. Costs have been cut and employers are not hiring until they see a bona fide uptick in demand.

Economic numbers have been improving, but the rate of improvement is starting to slow. As I'm mentioned in yesterday's comments, oil and transportation are not leading this rally. Oil prices have moved higher because the dollar has been tanking. Inventories are high and that tells me that demand is soft. This is the fabric to every economy and if activity was truly picking up, oil supplies would be depleted. Transportation companies are not confident about shipping activity and their statements about next quarter are guarded. This morning, a CEO from a major electric utility said that he expects flat demand for electricity over the next few years. That means the recovery will be slow to materialize.

The market is always evaluating information and the prospects for next quarter are being questioned. I still feel that the current conditions will overpower worries about what might happen next quarter. This is a temporary pullback and profit-taking has set in. If bearish sentiment increases, we have a chance to see a short covering rally. Many bears have been trying to pick a top for months and they have been carried out in body bags.

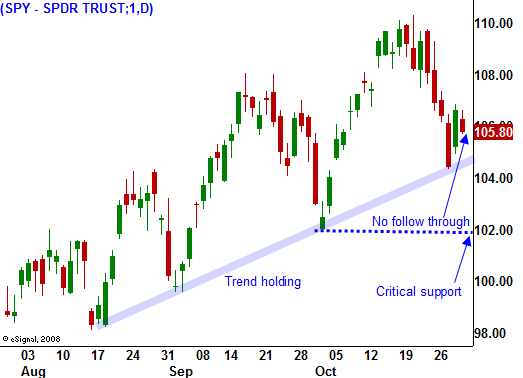

I expect to see nervousness ahead of next week's Unemployment Report, but I feel major technical support will remain intact. A weaker than expected Unemployment Report could actually be positive for the market. It will keep interest rates low and that will be one less worry for the market. After the initial decline, prices should stabilize and we should see a nice rally into Thanksgiving. I still feel that Asset Managers have money to allocate and they will bid for stocks once support is established. I have many great companies lined up for put credit spreading and my list of longs is four times the length of my short list. I am ready to fire now that we have seen a pullback.

SPY 104 could fall next week, but SPY 102 will hold. As long as it does, I will be selling put spreads.

For today, I feel this sell off is overdone and we might see an afternoon bounce.

Daily Bulletin Continues...